2 Charts to Keep Your Clients on Track Through the Coronavirus Selloff

The continued spread of the coronavirus (COVID-19) is impacting much of our daily lives — travel, schools, work, sports, and even the available supply of toilet paper. At times like these, we are tempted to grab control by “doing something,”

As citizens and as family members, we, of course, must be proactive and recognize that we need to exhibit good hygiene and not put vulnerable people in jeopardy. But as investors, however, we must remember not to be reactive and recognize that epidemics have historically been short-term events and that the global market typically recovers.

Uncertainty can be the antithesis of a productive investment experience. Panic and fear leads to emotional decision-making, and emotional decision-making typically hurts long-term financial wellness. Sometimes, the best course of action is actually no action at all.

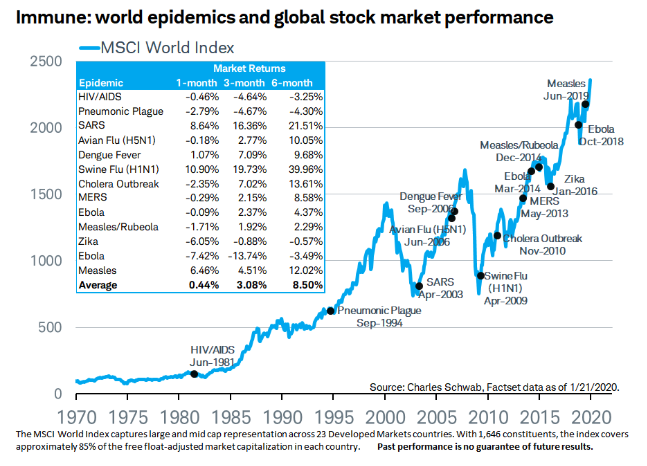

China’s recent stock market performance is a good example. It has handily outperformed the U.S. market since its infection rate peaked several weeks ago. And when we look at the past global health epidemics (see chart below), once each epidemic was officially identified, the stock market tended to produce above-average market returns in the year that followed.

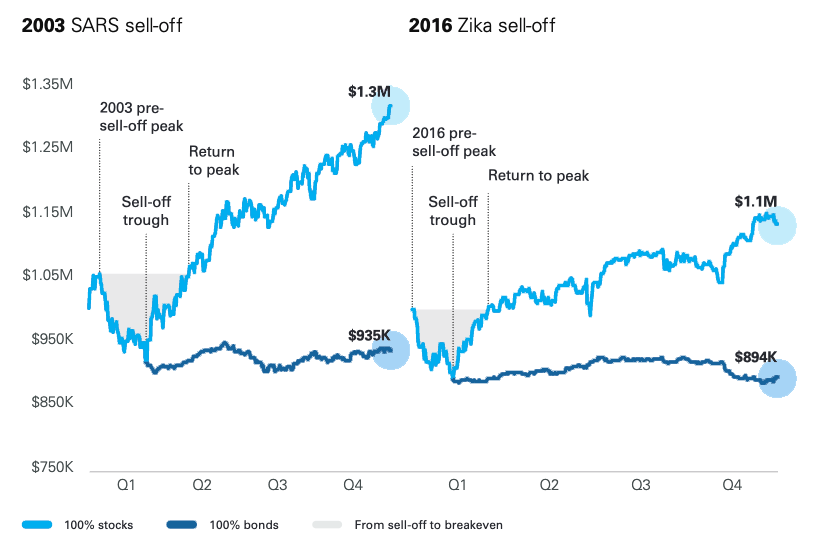

Global epidemics — just like SARS and Zika — are, ultimately, transitory in nature. The chart below shows that with each of those events it was unwise to get out of the markets, because you would have missed the rebounds that got markets back to their levels prior to the crises.

As advisors, clients look to you as a guide, especially in volatile times like these. You can demonstrate your value more than ever by keeping your clients grounded and in tune with their long-term investment strategy.

Hopefully, these charts can help you quell some of the fear and remind clients that while short-term trends can feel scary, they usually aren’t representative of long-term market performance.

Learn more about how Orion Portfolio Solutions can help you take the emotion out of investing with our turnkey asset management program (TAMP).

0631-OPS-3/16/2020