3 Steps to Improve Investor Decision Making

A financial advisor wears many hats. From managing taxes and constructing portfolios to advising investors on whether to save for college or pay off the mortgage, advisors can positively impact investors in many ways.

Yet, one of the most impactful ways an advisor can benefit investors has little to do with traditional investment strategy. Rather, it is rooted in monitoring and managing investor behaviors.

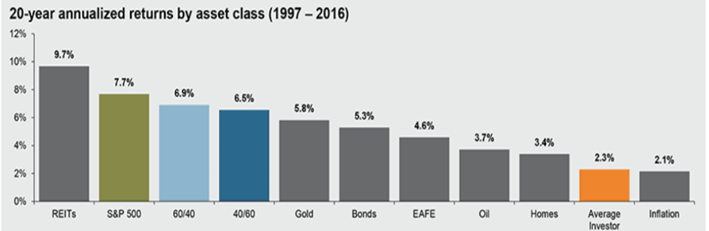

A look at 20-year annualized returns shows a yearly return of 7.7% for the S&P 500, and just a 2.3% return for the average investor.

Source: J.P. Morgan Asset Management, Dalbar Inc. Indexes

The average investor is significantly under-performing the market, which could translate into millions of dollars in lost opportunity.

So, what’s the root cause of widespread portfolio under performance?

Research tells us that 75% of portfolio return variance is driven by overall movement of the market – regardless of asset allocation mix1. That means additional influences, such as investor decision making, are negatively impacting portfolio returns.

Advisors must manage behaviors like they do the other core values of financial advice. Actively managing investments and helping guide investors through the obstacles to financial stability, such as how much to save, invest, and spend is no longer enough.

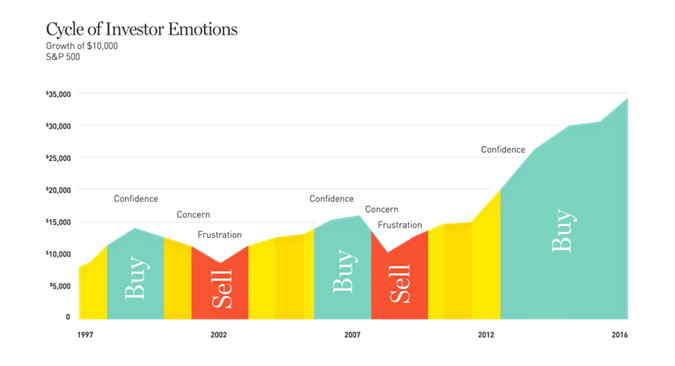

As markets rise, the average investor often seeks to capture a piece of that growth. Often times, they end up buying in too late. As the market falls, the average investor may experience anxiety as their hard-earned money is on the line. They often end up exiting the market at the worst possible time. As the market rebounds, they gain their confidence again, and the cycle repeats.

This is called the behavior gap. A lack of clarity and natural aversion to risk can lead to subjective decision making, which undermines the investor’s long-term interests.

That’s where you can provide value.

3 Steps to Bridge the Behavior Gap:

1) Prime each investor relationship for success. Focus on identifying and understanding your investor’s natural behavioral tendencies. Identify which market scenarios are likely to trigger subjective decision making (or what conditions are likely to create an uncomfortable investment experience).

2) Pair investor behaviors with their risk profile and time horizon. Create a more comprehensive investment picture, and identify strategies that are positioned to deliver a more comfortable investment experience.

3) Communicate effectively. Help your investors see past short-term market trends. Be transparent, and discuss the investor’s behavioral profile. Use those preferences to help validate your investment strategy.

By helping investors understand the market and focus on long-term financial stability, you can help reduce uncertainty and insulate portfolios from reactive decision making. Start with each investor. Invest in their natural preferences and expectations, and focus on managing the experience. You’ll find opportunity to both improve the investment experience and differentiate in an increasingly competitive market.

1 The Equal Importance of Asset Allocation and Active Management, April 2010