Active vs. Passive Management

For almost fifty years now, index funds have been eating away the market share of traditional active funds. What exactly are index funds, and how do they compare to traditional active funds?

Index funds are passive investment vehicles that seek to track the performance of a specific index such as the S&P 500 or the Russell 1000. In contrast, traditional active funds are based on stock selection; portfolio managers of these funds actively research securities and select those that they believe will outperform.

Index funds typically have lower fees and hold more securities than traditional active funds. Index funds are unlikely to perform very differently from their benchmarks and on average have beaten active funds net of fees. However, active funds are more likely to beat their benchmarks, oftentimes by a significant margin.

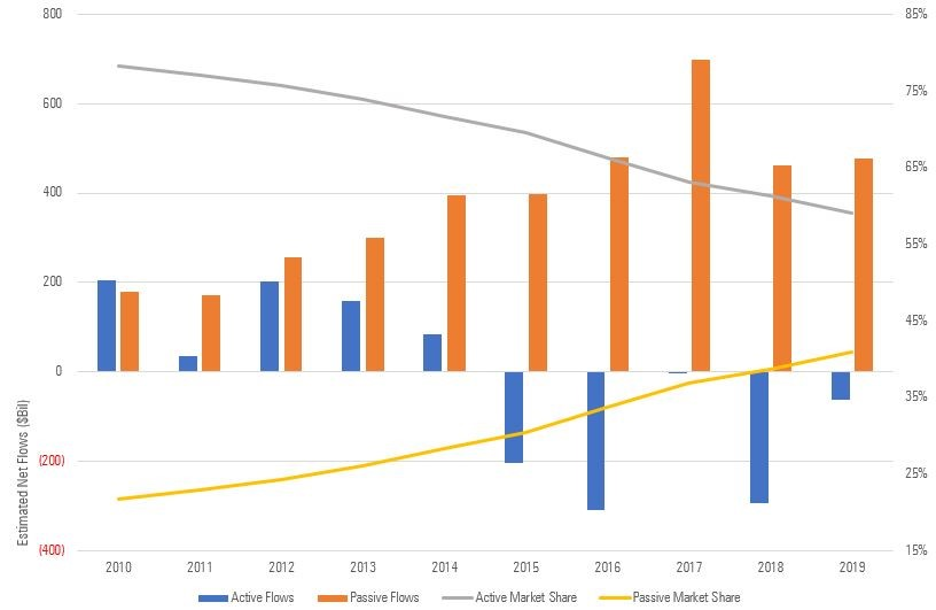

Figure 1: Active vs. Passive Flows. Source: Morningstar Direct. Data through 12/31/19.

A third group of investment strategies is often called factor investing, or smart beta. These strategies are similar to index funds, in that they tend to hold many securities and have lower fees. However, they are also similar to traditional funds in that they attempt to outperform an index.

Factor investors identify securities they expect to outperform, by screening the entire investment universe for specific factors, such as low price-to-earnings or high profitability growth. Unlike stock pickers, they do not select specific securities, but rather buy all securities that meet their screening criteria. Factor strategies are more likely to underperform or outperform their benchmarks than index funds are, but they do not diverge as much as traditional funds do.

Of course, the investment options available to clients are more varied than the three I have outlined here. The advancement of investment technologies, pioneered by firms such as Orion, and the significant decline in trading costs brought about by competition, have enabled the creation of new investment options that do not neatly fit into any of these categories. At Orion Portfolio Solutions, we offer tax-managed direct index portfolios that seek to track an index but hold fewer securities and may have greater tracking error than an index fund. These differences allow us to potentially lower a client’s tax bill, delivering what is called tax alpha.

The Orion Portfolio Solutions’ tax-managed direct index models are available through our TAMP technology. To find out more, click here.

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

2360-OPS-09/11/2020