April Market Review and Outlook – New Highs By Year-End?

Market Review

April was a “wow” month — in a good way. The rest of the year will likely add more wows. April was the best month for the U.S. stock market since 1987. It was almost the best since 1974, but the losses on the last day of the month held it back. This followed, of course, a bloody first quarter.

Over the last 20- and 50-year periods, April has been the best month of the year for generating the highest average monthly return. This year fortified that statistic.

Will April be the best month of the year? Given it was the best month in many years, it probably will be. But don’t count on it yet. Considering the sharp volatility of the markets, combined with extraordinary factors that qualify as kindling for more volatility, such as economic and health data, anything is possible this year.

And it certainly has been volatile in the stock market. After the fastest 10% loss, the fastest 20% loss, and the fastest 30% loss from a record high ever, the market turned around and produced the shortest bear market on record at just 33 days (a bull market is defined as a rally of 20% off the lows after a 20%+ loss from record highs).

Later in this section, we will discuss some reasons the market may climb higher. But first, the numbers from last month, which are a lot more enjoyable to review than the last few months.

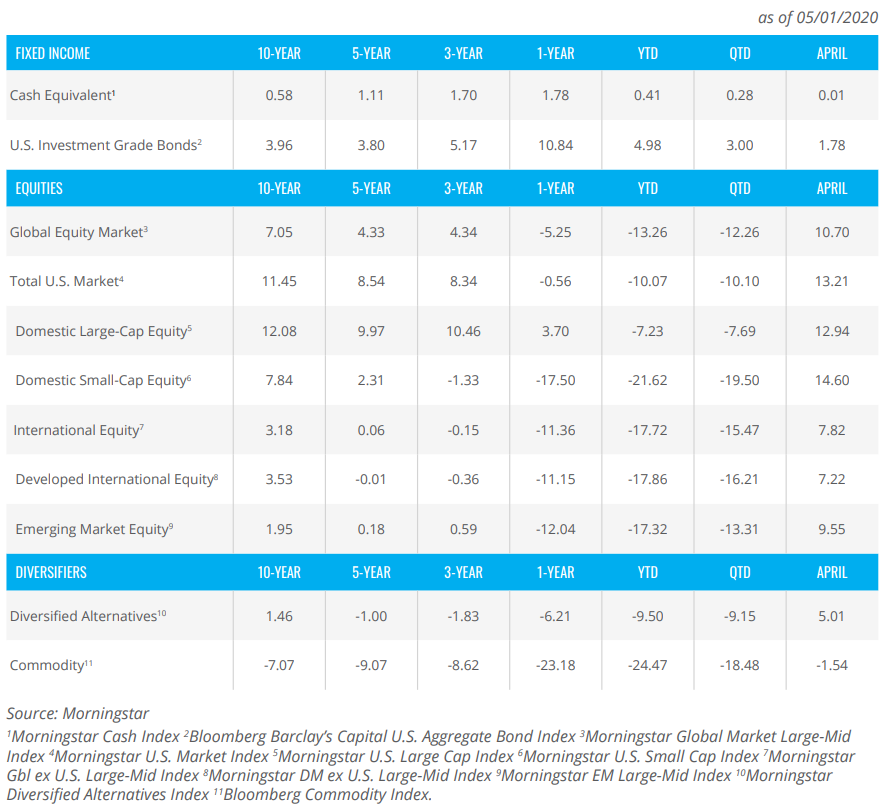

In April, the U.S. stock market rose more than 13%. Investors made nearly $3 trillion last month and have now made a total of $6 trillion since the beginning of last year.

Small-cap companies were up nearly 15% in April. International markets lagged, up less than 8%, with emerging markets (+10%) outperforming developing markets (+7%). Among diversifying asset classes, bonds were up nearly 2% while commodities were down nearly 2%.

Market Performance

Market Outlook

It may seem hard to fathom that April’s returns were so strong considering the many unknowns about COVID-19 and the extraordinary economic backdrop. There continue to be many concerning elements at play, such as:

- The possibility the bear market may retest its lows or hit new lows before a genuine, new bull market can begin

- Exploding federal deficits

- High valuations

- Lower corporate earnings

- Lower economic growth

- Lack of a vaccine or effective treatment for COVID-19

There is truth to each of these concerns, of course. But it’s important for long-term investors to note that none are likely to stop the stock market from generating long-term positive returns or even, possibly, hitting new highs this year.

Bear Markets

Bear markets sometimes retest their initial price lows, if not extend them. Essentially, this has occurred 50% of the time in the stock market’s history, depending on the time frame studied. The fact is anything can happen, so build diversified portfolios that are suitable for all market cycles.

Since the 1930s, the stock market has generated above-average returns after ‘big months’ in the following one-, three-, six-, and 12-month periods. In other words, April being a big month is not a reason to exit the market. If anything, it suggests more gains ahead.

Exploding Federal Deficits

The U.S.’s federal deficit is exploding. Economists disagree on this point, but many have argued for years that the deficit will be a problem for the economy and markets. So far, it really hasn’t, but this time could be a bit different. Government spending relative to the economy just increased by 50%+. Short-term, this is a big plus for the markets and economy. There is a lot of juice in the system, not only boosting investor and consumer sentiment, but it’s real money.

Longer-term, however, there could be a host of repercussions, such as higher inflation and weaker currency. These wouldn’t necessarily be showstoppers for the stock market, but it could mean different economic sectors take over market leadership.

High Valuations

The stock market was very expensive at the beginning of the year. After losing nearly 40%, it was less so at the March lows. Now, with the April gains, it’s back to being expensive, and arguably more so since fundamental metrics of value, such as revenues and earnings, have fallen.

Investors in an expensive market should expect below-average returns in the years ahead. While there is also a higher probability of a loss, the historical odds still overwhelmingly suggest a positive return. Even when a market is overvalued, it tends to produce positive returns over the following 1-, 3-, 5- and 10-years.

In addition, while the overall U.S. stock market is expensive, not all markets are extremely overvalued. International markets, especially emerging markets, have lower valuations. Within the U.S., smaller companies and more value-oriented economic sectors, such as financials, are also more attractively priced for better expected returns. In other words, a globally diversified equity portfolio should outperform the U.S. large-cap centric S&P 500 in the years ahead.

Lower Corporate Earnings and Economic Growth

There were some terrible economic and corporate earnings growth numbers in the first quarter. The second quarter’s numbers will be worse — historically bad worse, all-time bad worse. It may take years for the U.S. economy to fully recover. However, the stock market typically bottoms 3-4 months before the economy does. Considering we just had the fastest 10%, 20%, and 30% drops, and the shortest bear market ever, wouldn’t it be plausible for the economy to find a trough quicker, too? In fact, the absolute worst has probably already been seen given the initial claims for unemployment data. Let’s all hope.

Curbing COVID-19

The most important signal, of course, is the COVID-19 data. The good news is U.S. and global growth rates have apparently peaked. When that has happened in the past, either around the world during the current pandemic or during past pandemics, it typically signals better economies and markets.

Now, while there may be a second wave (and perhaps more) and the coast is absolutely not clear, there are some other positives to keep in mind. The magnitude of global collaboration on COVID-19 from the health care and technology communities is unprecedented. Everything is moving faster now. It seems probable that treatments and vaccines will also be developed faster than they have historically. While public officials need to plan for the worst, the probabilities seem to suggest positive developments will occur quicker than the worst headlines indicate. Again, let’s all hope.

It’s illustrative to note market behavior around the two worst pandemics of at least the last century. The Spanish Flu had three prominent waves in 1918 and 1919. The second wave was indeed worse than the first. Two hundred thousand Americans died in October 1918 alone (when the U.S population was only 30% what is now)! The third wave occurred in the spring of 1919. However, the U.S. market generated strong, double-digit returns of approximately 20% in both 1918 and 1919 and then averaged 15% returns per year in the Roaring ‘20s that followed.

That said, I don’t think the Spanish Flu is the best example as the market had other notable influences at that time, such as World War I. A better example is the Asian Flu in 1957. In this case, the market was coming off a seven-year bull market that snapped at the time the Asian Flu hit the U.S. in the summer of 1957. The Asian Flu was also a big, bad deal as the population-adjusted equivalent of 200,000 Americans died. The infection rate peaked in the late fall of 1957. The economy took a significant GDP hit in the fourth quarter of 1957, and then had its worst quarter of GDP growth since WWII (until the upcoming second quarter that we will likely soon witness) with a 10% loss. The stock market lost ground in 1957, but it generated a 40%+ gain in 1958 and then didn’t have a losing year until 1962 (when it lost 2%).

Need more reasons for the possibility of new highs?

Investor sentiment was still very negative at the end of April. That’s a bullish sign for future returns. The ‘Wall of Worry’ is still intact.

Also, while consumer confidence has taken a big hit, it’s still near the 20-year average. “Don’t fight the consumer.”

And I haven’t even mentioned “Don’t fight the Fed.” The Federal Reserve has short-term interest rates essentially pinned at zero for the foreseeable future and has flooded the system with money, acting as a backstop for the markets, including many segments of the fixed-income markets. Quite frankly, this might be the most important reason the market could still move, if not explode, to new highs (especially with a good news catalyst on the COVID-19 front).

Lastly, small-cap stocks are now showing some strength, even outperforming toward the end of April. This will be important to watch. A sign of a healthy market is when it has good “breadth” of participation, meaning market leadership isn’t just in a handful of names. If that’s the case, add “Don’t fight the tape” to the list of positives.

Want to stay on top of market volatility, trends, and developments? Check out our Market Volatility Command Center, featuring regularly updated market commentary and through leadership from our strategist partners and Investment Team. Click here to view and subscribe.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

1231-OPS-5/8/2020