How SMAs Can Help You Get Into the HNW Game

The ability to attract and serve high-net-worth (HNW) investors is essential to growing advisor businesses.

HNW clients provide an obvious benefit to an advisor’s bottom line – particularly under the AUM-based fee model that has become standard in our industry. They are also a great source of efficient and scalable growth. An advisor generating greater revenue with fewer clients can not just improve their overall profitability, but also the quality of their investment experience by re-investing those time savings into additional value add services, such as tax management, philanthropy guidance, and retirement planning.

The key is finding the right solution to help you not just attract, but efficiently serve HNW clients. For the advisor who has little or no experience catering to the HNW audience, Separately Managed Accounts (SMA) could be your ticket into the community.

What’s a Separately Managed Account

Investopedia defines an SMA as a privately managed investment account opened through a brokerage or financial advisor that uses pooled money to buy individual assets. What that means, practically, is that SMAs allow you to deliver a more tailored investment experience to the HNW client, allowing them to own their own assets.

SMAs are typically facilitated through third-party money managers, who handle the bulk of the daily investment management workload. These managers will partner with you (the advisor) and your HNW client to create a personalized investment plan. They then execute on that plan, alongside you, in search of accomplishing the unique goals of that client.

Use SMAs to Gain Traction with the HNW Audience

SMAs serve as a valuable tool for financial advisors seeking to serve and attract HNW clients by reducing many of the challenges associated with managing them.

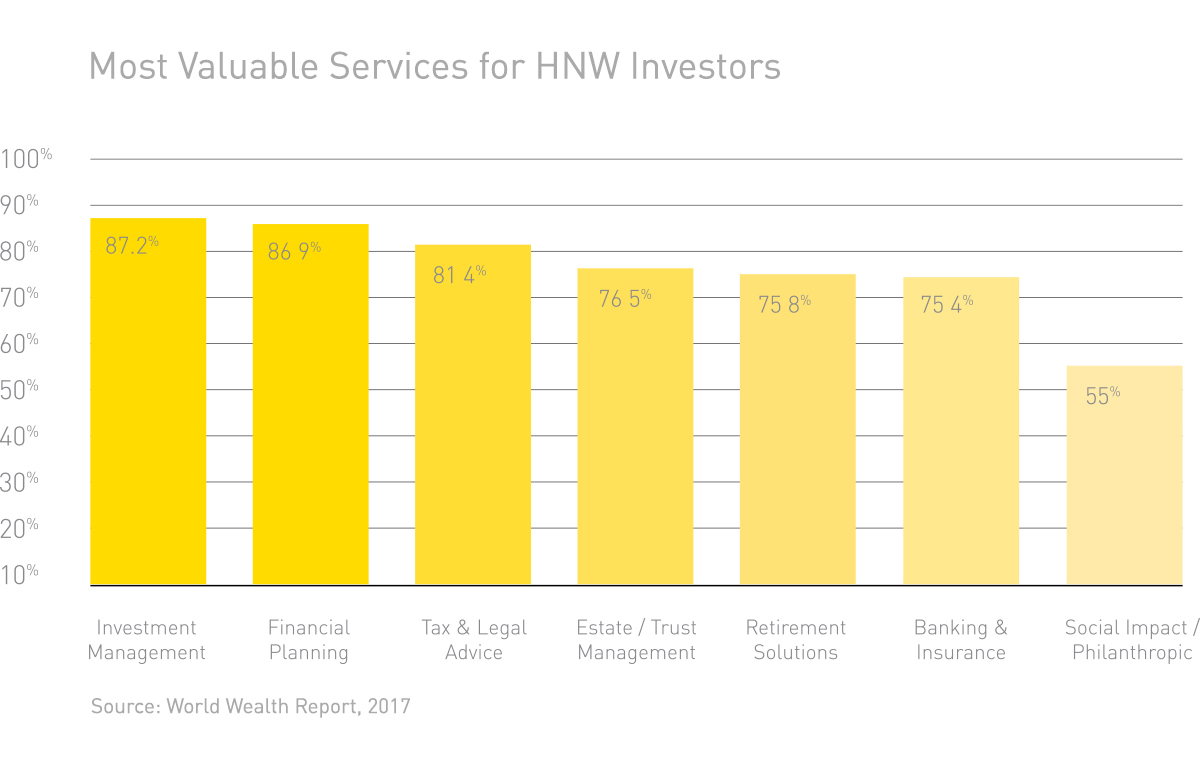

HNW clients tend to have a greater set of needs than your average mass affluent investor.

SMAs typically offset a large portion of the burden associated with investment management and financial planning by leveraging the guidance of dedicated third-party money managers. That gives you more time and energy to focus on covering additional areas of interest for your wealthier clients. While the commoditization of financial advice might not be as relevant to the HNW and Ultra HNW investor segment, the trend of broadening advisor value is likely still going to be present, making your ability to serve as a holistic financial resource even more important. That’s especially important with HNW clients who are likely to end their financial advice relationship if their needs aren’t being met (over 75%)1.

SMAs also might better cater to your HNW client’s mentality. In an SMA program, the money manager is typically accessible to the HNW client, giving them a greater feeling of involvement and control in the investment process. You may expect a HNW investor to want a more hands-off approach, where they receive a greater degree of service, but the opposite is true. HNW investors are highly confident in their own ability to handle the family’s money (82%)2. And while 90% of HNW investors cite smart investing as a factor to wealth creation, only 43% recognize decisions made for them by financial advisors as influential3.

Lastly, SMAs provide a more targeted investment approach that is appropriate for the unique needs of HNW clients. An example is tax management. As net worth increases, so does the impact of taxes on a portfolio’s overall performance. SMAs typically feature unique investment options and strategies to minimize the impact of taxable events, such as the realization of capital gains.

How to Integrate SMAs into Your Strategy

Using SMAs is relatively simple. Either work directly with a third-party money manager that offers an option that suits your needs, or look toward your investment platform (many of which have SMA programs). Ensure proper due diligence has been taken to vet and monitor each program, as there is typically a smaller margin for error when working with HNW clients.

Once chosen, think about how that program will fit into your overall service environment, and how you will deliver it to your clients and prospects. Make your SMA program visible (whether through your website or direct marketing initiatives), and highlight the primary benefits you’re prepared to deliver to HNW investors – increased investment transparency and control, reduced tax burden, and remarkable investment flexibility.

Are you interested in upping your HNW game? If your value is best defined by the experience delivered to your clients, as opposed to stock picking and daily investment management, then SMAs could be your ticket to increased AUM and profitability.

1United States Wealth Report, 2015

2U.S. Trust Insights on Wealth and Worth, 2017

3Spectrem Group, “financial behaviors and the investor’s mindset”, 2015