Incorporating Liquid Alternatives – Part One

Traditionally, hedge funds have been reserved for large institutional investors looking to add non-correlated investment strategies to their existing portfolio of stocks and bonds. Key features that discouraged retail investors from participating include:

- High Minimum Investment

- K-1 Tax Forms

- Redemption Gates

- Illiquid Assets

- Carried Interest Performance Fees

- Lack of SEC Regulatory Oversight

Liquid alternatives are considered the plain vanilla hedge funds for the main street investor. They are available to investors in the form of traditional mutual funds, which must meet ’40 Act SEC regulatory standards, are daily liquid, and do not charge performance fees.

Since liquid alternatives exhibit lower fees and greater transparency, it was believed at the time of their initial launch that they would be transformative to the industry. The reality is that their success could be considered “spotty” at best. Asset growth seemed to stall in 2013 in the wake of more traditional assets like domestic large growth and traditional fixed income performing exceptionally well.

In today’s world, AAPL has a larger market capitalization than the Russell 2000 and yields on traditional fixed income flirt with their 0% lower bound. Who knows if these trends will continue, but if they revert to their longer term historical averages, non-correlated liquid alternatives could be a great risk mitigator in times of uncertainty.

Another important consideration when selecting alternative investments is that they are not alternative in asset selection. Take market-neutral or long-short and you’ll find that they are still entirely comprised of stocks, but the mechanisms for shorting and changing net exposure will derive a lower correlated/differentiated return stream relative to that of long-only stock portfolios.

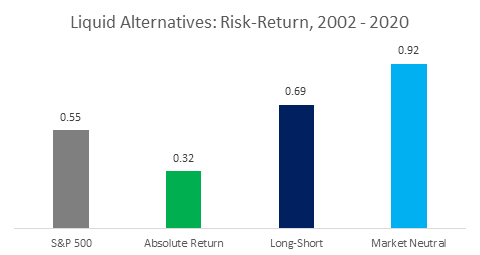

On a risk-adjusted basis, liquid alternatives still look attractive. The three areas to focus on are market-neutral, long-short, and absolute return. Even though market-neutral and long-short are still completely comprised of stocks, they have the potential to achieve higher risk-adjusted performance relative to just S&P 500 due to their risk mitigation techniques.

Source: Bloomberg as of 6/30/2020

Absolute Return strategies are well-diversified multi-asset alternatives which incorporate other asset classes in addition to equities such as fixed income, commodities, and currencies. Another layer of complexity is that they will tactically change allocation across the various strategies and assets in an attempt to create alpha and mitigate risk. The low risk-adjusted performance has been predominantly associated with lack of return opportunity in assets outside of equities and not with their ability to achieve a low risk profile similar to that of traditional fixed income.

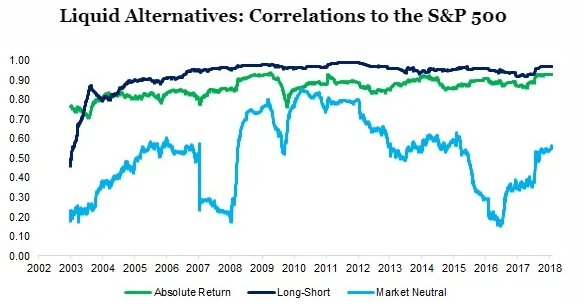

While higher risk-adjusted performance is great, we need to understand how incorporating these strategies will help with portfolio diversification. It turns out that absolute return strategies generate a great deal of their total returns from credit exposure. High yield credit, while still a fixed income instrument, is much more sensitive to the underlying fundamentals of a company, much like equities. This has led to a higher than expected rolling correlation to the S&P 500.

Source: Bloomberg as of 6/30/2020

While liquid alternatives haven’t been able to live up to the hype of their hedge fund big brother, they still can be an influential addition to the portfolio construction process. With more uncertainty around equity valuations and where yields might go on fixed income, incorporating not only differentiated assets, but also alternative strategies, may help mitigate risks while large market dislocations converge.

Find part two here

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org .

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.

The CFP ® designation is a professional certification for financial planners conferred by the CFP Board. CFP® professionals have completed extensive training and experience requirements and are held to rigorous ethical standards, while understanding the complexities of the changing financial climate, and know how to make recommendations in their clients best interest. To learn more about the CFP®, visit https://www.cfp.net/home.

2622-OPS-10/15/2020