Market Insights: Last Week in Review with Rusty Vanneman, CFA, CMT, Vol. 86

Last week finished another tough month in the markets, eventually bringing the quarterly return also into negative territory:

- Losses were driven by a few factors including higher than expected inflation data (more on this later), concerns over global credit/currency (especially in Europe), and a slowing economy (and the potential for corporate earnings to start dropping) (MarketWatch, Oct. 2022).

- September is usually a weaker month for the stock market, but last month was still the worst September since 2002 (MarketWatch, Oct. 2022).

- The S&P 500 logged a third straight quarterly loss for the first time since 2009 (MarketWatch, Oct. 2022).

- The US equity bear market was officially extended last week (MarketWatch, Oct. 2022).

- The market is now down 25% off its all-time highs (MarketWatch, Oct. 2022).

- For the week, domestic stocks lost over 3%; International stocks lost ~2%; Bonds and Commodities were both down by less than 1% (MarketWatch, Oct. 2022).

Before we dive into the Bullets, let’s add some potential cheer and review a quick handful of reasons to be bullish!

- We are entering what is typically the best time of year for 3-month forward returns (CNBC, Oct. 2022).

- Presidential Election Cycle. Returns are typically strong after the mid-term election (CNBC, Oct. 2022).

- It’s at a bearish extreme – four times sentiment has been this bearish in the last 35 years (CNBC, Oct. 2022). In all four of those situations, the market was up 12-months later with an average 30% return (CNBC, Oct. 2022).

- Low prices sent up better future returns. Hat tip to Ben Carlson of A Wealth of Common Sense on the powerful table he posted in his Oct. 2, 2022 article “Getting Long-term Bullish with data from YCharts. In short, 25% losses typically set the stage for above-average returns 1-, 3-, 5- and 10-years later (YCharts, Oct. 2022).

- Often considered one of the wisest of sayings: “This Too Shall Pass.”

For the quarter, US stocks lost just under 5% (Morningstar, Oct. 2022). The average US stock lost just over 4% (Morningstar, Oct. 2022).

- Non-US stocks lost 9%, with the greatest losses being driven by a US dollar up a whopping 7% the last three months (Morningstar, Oct. 2022).

- Bonds were also down just under 5% and commodities down about 4% (Morningstar, Oct. 2022). It was tough to find places to hide last quarter.

For the year, the asset classes with gains are Commodities (~14%) and Cash (~1%) (Morningstar, Oct. 2022).

- Within equities, the only sector with a gain is Energy (+34%) (Morningstar, Oct. 2022).

Quite a week for interest rate volatility last week, including these headlines:

- US 10-Year Treasury Yield posts biggest one day drop since 2009 (Wall Street Journal, Sept. 2022).

- As of Sept. 26, 2022, 10-year Treasuries on pace for worst year ever (Charlie Bilello, Sept. 2022).

- In the end, last week Ten-year Treasury yields finished at 3.80% (up another 10 basis points over the last week); the highest yield last week was 3.99% (Yahoo! Finance, Oct. 2022).

- The yield to maturity on the Bloomberg Aggregate Bond Index also rose last week to 4.71% (Bloomberg, Oct. 2022).

- At one-point last week, the yield on the Bond Agg had not been that high since Dec. 9, 2008 (Bloomberg, Oct. 2022).

- The average money market yield screamed higher last week, rising nearly 50 basis points to finish at 2.66% as of Oct. 1, 2022 (Crane Data, Oct. 2022).

- The average 30-year fixed mortgage rate increased to 6.82% (up 40 basis points) last week (Bankrate, Oct. 2022).

Deeper Dive

Needless to say, fixed income performance appears to have really weighed on conservative portfolios’ performance. Hat tip to Brinker Capital’s Michael Hadden on the following data … but did you know: “Going back to 1950 the Morningstar peer group for allocation funds 30-50% equity has seen a calendar year negative return of >-10% only 5 previous times (YTD-17.01%) and >-15% only 2 times. Subsequent average return after years of -10% is 15.58, median of 20.38. Average of the 2 occurrences after a -15% year is 25.80%. This might be a great talking point particularly defending fixed-income heavy balanced portfolios. Maybe even more encouraging is the 5 year forward annualized return following a -10% year is 10.8%.”

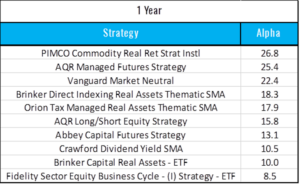

Regarding 1-year returns, here are the strategies on the Orion Portfolio Solutions (OPS) platform with the best risk adjusted 1-year performance versus the S&P 500 (as of Aug. 31, 2022):

Source: Orion Portfolio Solutions

Regarding the strategies that are generating the most inflows at OPS, check out the just released Monthly OPS Flows Webinar from August 2022.

Speaking of the curated open architecture at OPS, did you know these cool stats (through Aug. 31, 2022)? This year the Orion Due Diligence team has:

- conducted 170 meetings; and

- written 54 Guiding Star reports.

When it comes to historical returns, the 3-year numbers still have some nice positives.

- The US market is about 8%/year for the last three years (Morningstar, Oct. 2022).

- Growth stocks still lead Value stocks by nearly 4%/year over that time frame (even though Value has outperformed Growth this year by 23-25% if you’re looking at year-to-date or 1-year numbers) (Morningstar, Oct. 2022).

- International stocks slipped to -1%/year (Morningstar, Oct. 2022).

- The bond market is down 3%/year – that’s amazing (Morningstar, Oct. 2022).

- Commodities are up over 13%/year for the last three years (Morningstar, Oct. 2022).

The dollar has been on quite a run. Can it continue? Of course it can, particularly with how trends often persist in the currency markets. That said, according to GMO’s Quarterly Letter for Q2 2022, the dollar is very overvalued. That could suggest a nice tailwind for international stock outperformance if that valuation reverts back to the mean – which it eventually will.

Inflation is not good for stocks, but one potential good thing about inflation is that more people tend to invest more in stocks. This Sept. 26, 2022 article by the “Grumpy German” Joachim Klement explains it all. It might also explain why investors haven’t really sold stocks this year despite strong bearish sentiment.

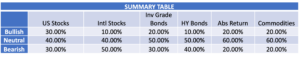

It’s time for another Monthly OPS Strategist survey for their 6-month outlooks on six major asset classes. In short, it’s not very bullish anywhere you look.

Source: Orion Portfolio Solutions

Key economic data last week included some encouraging housing data, but inflation data disappointed:

- First, new home sales surprised to the upside. Commentary from First Trust on Sept. 27, 2022:

- New home sales posted the largest monthly gain in more than two years in August, crushing even the most optimistic forecast by any economics group. While the headline gain of 28.8% is a welcome piece of good news, it’s important to remember that new home sales are still down 33.9% from the peak in 2020. That said, today’s report is a sign that sales activity may be beginning to stabilize

- The median price of new homes sold was $436,800 in August, up 8.0% from a year ago. The average price of new homes sold was $521,800, up 11.0% versus last year.

- Also, here’s another positive sign about home prices: weekly house prices after 11 weeks down. (Redfin, Sept. 2022)

- Inflation, however, is still surprising to upside though, including PCE Inflation for August accelerating. (CNBC, Sept. 2022) Regretfully, this is not peaking – according to the Fed’s preferred inflation measure as shown on a Bloomberg chart from Sept. 2022.

Also, no real surprises from Final 2Q GDP Growth (First Trust, Sept. 2022). It remained at a -0.6% annual rate, matching consensus expectations.

- The GDP price index was revised up to an 9.0% annual growth rate from a prior estimate of 8.9% (First Trust, Sept. 2022).

- Nominal GDP growth – real GDP plus inflation – was revised up to an 8.5% annual rate from a prior estimate of 8.4% (First Trust, Sept. 2022).

Thanks to the better-than-expected economic data last week, the Atlanta Fed’s GDPNow‘s estimate for real (“after-inflation”) GDP growth (which uses actual economic data for inputs) increased by a healthy 2.2% last week to currently estimate 2.4% for Q3 2022 GDP (GDPNow, Oct. 2022).

The key report this week on the economic calendar on the Calculated Risk Blog is the September employment report on Friday.

- The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7% (Calculated Risk, Oct. 2022).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Cryptocurrency prices were mixed last week. Bitcoin managed a 1% gain but is still trading under $20k; Ethereum was flat on the week at $1,300; Polygon, Tron, and Uniswap were the only other major coins sporting a gain (CoinMarketCap, Oct. 2022).

- Christies – the 256-year-old auction house – launched an Ethereum NFT marketplace (Decrypt, Oct. 2022). Crypto exchange FTX continues their buying spree as they won a bid to buy bankrupt firm Voyager’s assets (Decrypt, Oct. 2022). Bitcoin miner Rhodium plans to go public via SPAC deal (Decrypt, Oct. 2022).

- Outflows from crypto-related fund and ETFs slowed down in the third quarter after massive Q2 outflows (ETF.com, Sept. 2022). There were no new US crypto-related ETF launches. Blackrock launched a new Blockchain ETF in London (ETF.com, Oct. 2022).

Additional Resources

In investing, what is comfortable is rarely profitable.” Rob Arnott (GoodReads, Oct. 2022).

Last week’s Orion’s The Weighing Machine podcast was with Billy Oliverio, EVP and chief marketing officer at United Planners Financial Services. Tons of energy and laughter on the podcast and, in turn, lots of great comments on the podcast. Thanks for listening. This coming week on the podcast we have John Crawford and David Gilmore from Crawford Investment Counsel. Dividend oriented strategies have been performing well this year, and Crawford is no exception. Besides learning about Crawford, you have to check out their walk-up song. Best one yet?

Looking for another podcast for your listening and edification pleasure? Be on the lookout for the new Orion podcast “Weighing the Risks” focusing on Orion Risk Intelligence scenarios. The topic is 2022 Mid-Term Election. It’s the old Hidden Levers War Room, but now in podcast format. Excited to get feedback on the new format, though it’s impossible to replace the personality of Raj Udeshi.

Like I needed a new weekly blog to read, but the “Postcards from Florida” by Garrett Baldwin is so good. He’s entertaining, thought-provoking and he just lets it rip. Here is a link from a recent post on LinkedIn regarding the Fed’s recent comments (Garrett Baldwin, Sept. 2022).

I went to a conference at MIT a few years ago when a former European central banker was talking about central bank forecasts (focusing on the Federal Reserve). In short, it’s absolutely stunning how consistently wrong – and often by significant amounts – their forecasts were/are. I keep meaning to do a study on that. Conclusion: the Fed is a political animal and the public data usually sways what it eventually does.

How do you compare? How Americans Spend Money by Generation (Visual Capitalist, Sept. 2022).

Speaking of spending habits, here’s a quick and easy Retirement Expense and Income calculator from Jackson Financial.

And one more on spending habits. Here’s an article about one of the smartest and nicest people in the industry and his new business, which is sort of like a “Budget Robot” – and has some of the best and brightest investors backing him (RIABiz, Sept. 2022)! I bet we’ll all hear more about Budge in the year(s) ahead.

Inspiring 2-minute video from Ryan Holiday on “You Control How You Play” on YouTube from Oct. 25, 2019.

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at www.orionportfoliosolutions.com/blog.

1851-OPS-10/5/2022

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.