Monday Morning Market Insights: Last Week in Review with Rusty Vanneman, Vol. 47

- Happy Monday. There are less than three weeks to go for many to wrap up their holiday shopping. Personally, I need to get after it this week myself!

- Last week wasn’t a good week in the markets. In the end, while the S&P 500 ETF (SPY) only lost a bit less than 1% for the week, that was deceptive. The overall US stock market was off nearly 3%, small caps lost over 5%, and commodities lost over 8%. International markets also slid, though not as much as the US market. COVID concerns hit the markets hard the day after Thanksgiving and coupled with the Fed’s recent tough talk on inflation, it caused some notable movements in high valuation stocks (sharp losses), the yield curve (flatter), commodity prices (sharply lower), digital assets (sharply lower), and credit spreads (significantly wider).

- Despite the losses last week, the US market is still up on the month so far, with only growth stocks sporting a month-to-date loss. Monday’s opening appears to only amplify those numbers. Part of the strength Monday morning is due to some encouraging news on omicron: Fauci: first data on omicron is encouraging.

- For the year, the US stock market is still up over 21%. The leading segment of the US market remains small cap value stocks up over 27%. Real assets such as commodities and REITs are still leading the way, with respective gains of nearly 22% and over 33%, respectively. The overall bond market is down about 1% YTD.

- This next bullet would have been better in last week’s Bullets, but let’s talk about how remarkable the losses were from the day after Thanksgiving. According to the investment firm Marketfield: “Over the years if you wanted to bet on a single session in the calendar year being positive then the day after Thanksgiving has been a good one to pick. There is no obvious reason for this other than the general goodwill which pervades the US on this most human of holidays, but this general trend was not enough to overcome the news that a new Covid variant had been discovered in South Africa. To put this session in perspective, it was the largest post‐ Thanksgiving decline since 1941, when the threat of war with Japan dominated market concerns.”

- Besides COVID-19, the most significant market news was last Monday when Fed Chair Powell said that the word “transitory” would be retired when talking about inflation in testimony to Congress and that a faster pace of tapering may be appropriate. One market saying I learned as far back as the ’80s was “Don’t Fight The Fed”. In other words, investors/traders should align their investments with what the Fed is doing with interest rates (and more).

- Last week’s big economic data were nonfarm payrolls on Friday. The 210k increase in November was well below the consensus expected 550,000, but it was a quirky number. Perhaps most significantly, the unemployment rate dropped to 4.2% in November from 4.6% in October. With unemployment officially this low, many believe it would allow the Fed to move even faster on tapering and fighting inflation.

- With the COVID news combined with the Fed’s comments and the labor data, Ten Year Treasury Yields dropped 14 basis points last week to 1.34%, its lowest levels since September 21, 2021.

- Despite the drop in interest rates, the Fed’s comments about being tougher on inflation had an impact on high valuation stocks, the high-flyers from last year and early this year, have been notable. First, did you see some of the losses in stocks that benefited from stay-at-home investment theme last week? Zoom dropped over 16%; Netflix lost nearly 10%, and DocuSign dropped more than 40% on Friday alone.

- Also, here’s a fascinating study from Bespoke Investments regarding the ARK ETFs from Cathie Wood. “Back in 2019 and 2020, the flow weighted average return was nearly 40% from inception for the universe of 5 ETFs the company offers. But now, weighted by flows, the typical investor in ARK products is basically down 5% since inception, and inflows of cash to the funds which allowed more buying of existing holdings are sliding into reverse as the process plays out to the downside just as it did going up.” Despite ARK’s Cathie Wood’s fantastic communications and clear investment philosophy, investors still chase performance.

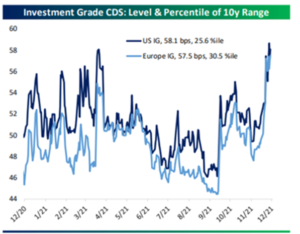

- Credit spreads moved higher last week. Over the past few decades, wider credit spreads have typically accompanied stock market weakness. This will be something to watch. Again, according to Bespoke Investments.

- Despite this being the 12th bullet point, COVID remains the top issue for all of us as humans, not just as investors. First Trust has an informative one-page weekly summary of the current COVID landscape: COVID Tracker. One comment from this past week’s Tracker: According to their Nationwide Blood Donor Seroprevalence Survey, as of September 2021, the CDC estimates 91.8% of the U.S. population ages 16 and older have developed antibodies against COVID-19, through either vaccination or infection.” This said the Omicron variant is still a mystery in some respects. While my glass-half-full eyes seem to be reading more encouraging updates about Omicron, there will no doubt be near-term volatility as we learn more about it. My wife is traveling to Europe for business this week. Man, it would stink if she stuck over there during the holiday season.

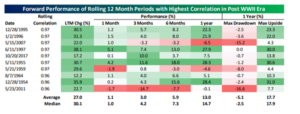

- Okay, let’s find a positive in the market data. Though it may sound counterintuitive, one big plus is that investor sentiment plummeted in recent weeks. Looking at AAII Sentiment data, it just had its biggest three-week decline since March 2018. With only 27% of respondents bullish, market optimism is at the lowest level since the first week of October. Bearish sentiment is now over 42%, its highest reading in bearish sentiment since the first week of October of last year. Given these levels, this has historically been a plus for the markets moving forward, with above-average returns in the 1-, 3, 6-, and 12-month time frames according to Bespoke Investments:

- Small caps underperforming is not a good sign for active investment managers. When the largest stocks in the index are outperforming, as they have in recent years, it’s hard for active managers to outperform. On this point, I read somewhere that actively managed investment strategies are the most underweight of the top stocks in the market ever. According to The Felder Report, one can both see why the top stocks have done well (they have had spectacular growth), but also why many active managers are underweight (growth is expected to significantly drop).

- Real estate prices are also on fire, and that includes a $4 million deal on the metaverse!

- Bitcoin had a crazy weekend, as BTC fell from around $54k down to nearly $42k. Since then, it has been trading in a range between $48,000 and $50,000. Stocks such as Coinbase have also been slammed. Bitcoin prices are now at $48k and Ethereum is just above $4k.

- This week’s economic schedule is less active than last week’s with the biggest numbers being on Friday with sentiment and inflation (CPI) data.

- This coming week’s guest on Orion’s The Weighing Machine podcast is Scott Henderson from Calamos. With interest rates so low, many advisors and investors are looking for ways to creatively diversify equity risk in their portfolios. Scott had a few ideas on how to do that. As always, thanks for listening.

- Here’s the awesome picture of the week – a meteor over Macedonia.

- This time of year is so awesome in so many ways, including all of the cool “Best Of The Year” lists for movies, books, and music. This year I really slipped in the movie watching as the various “best of” lists were mostly movies I haven’t watched yet, nor even heard of! Here’s another list from a favorite economist of mine, Tyler Cowen, who quite frankly I think is so knowledgeable in many areas including movies: Tyler Cowen’s Best Movies of 2021 List. What makes this list interesting is the reader feedback too. Tyler definitely has his fans – and anti-fans! BTW, Another Round was indeed a fascinating movie.

- Thanks for reading and have a great week! For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com.

3058-OPS-12/6/2021

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.