Monday Morning Market Insights: Last Week in Review with Rusty Vanneman, Vol. 52

- Happy Monday. The new year is off to a busy and bumpy start – good thing next week already has a holiday in it (MLK Day on Monday)!

- This year started tough for the overall US stock market, which was down over 2% last week (and more expected price weakness to start the week). Growth stocks were down over 6% last week, while Value stocks were UP with a gain of just less than 3%. International stocks had a slight loss on the week.

- Diversifiers were mixed. With rates rising, the overall bond market lost more last week (-1.53%) than it did all last year. Diversified alternatives had a slight loss. Real assets such as commodities were up over 2%.

- The leading reason for the respective market movement last week is that the Ten Year Treasury Yields gained 26 basis points (over a quarter of 1%) to close the week at 1.77%. The intra-day high yield last week was 1.80%. Both of these levels took out the respective 2021 high yields for both intra-day high and closing 10-year yield. They almost took out the 2020 highs too. The last time yields were this high for 10-year Treasuries was January 17, 2020.

- The jobs report was released Friday, and while the number of jobs added was below the expectation of 422,000 at 199,000 jobs, the unemployment rate fell to near pre-pandemic levels at 3.9%. Combined with wage growth levels well above pre-pandemic levels, this could be a positive economic factor compared to other potential issues with Fed talks and inflation levels.

- COVID-19 remains the biggest issue in our lives, and we have all suffered because of it. Given recent price action, it appears that investors are now regarding COVID news much like terrible weather events. Tragic first and foremost in human terms and secondarily in immediate economic terms. That said, the weather is transitory. Investors are looking forward.

- That last comment/thought really came from the research firm RenMac. For those who want a deeper dive into the economy, a great short podcast (~15 minutes at regular speed) every week is RenMac’s Friday Podcast. Other highlights this past week on their podcast include discussion of the importance of the unemployment rate being now under 4% and wage growth above 6%. If anything, they think the Fed will be more aggressive and begin to raise short-term rates in March.

- Related to that point, and for those who want something even deeper than that (and for those who have been in the profession awhile), the podcast interview last week with Jim Bianco (IMO) was gold. Jim Bianco on Fill The Gap podcast.

- If Treasury yields continue to rise, does that mean the bond market is definitely going to lose ground? Not so fast. Remarkably, even in rising yield environments, the bond market has a strong tendency to post positive nominal returns. More nuggets like this are in the OPS Quarterly Reference Guide.

- This week’s economic schedule starts off slow with nothing on Monday, but picks up with plenty of Fed confirmation news and speak (Tuesday and Thursday) and inflation data:

- On Wednesday, the Consumer Price Index for December had a consensus outlook for a 0.5% increase in CPI and a 0.5% increase in core CPI. The expected year-over-year increase of 7.1% would be the largest year-over-year increase since 1982.

- On Thursday, the Producer Price Index for December had a consensus outlook for a 0.4% increase in PPI and a 0.5% increase in core PPI.

- The current estimate for 4Q2021 GDP according to GDPNow has been dropping. It is now at 6.7% (from 7.6% last week).

- Notably, earnings season starts in earnest this coming week, particularly with some of the largest U.S. banks. JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) are each slated to report Friday morning before the opening bell. The results come following a strong run for bank stocks, with financials currently the second-best performing sector in the S&P 500 in 2022, after energy. The XLF, or exchange-traded fund tracking the financial sector, hit a record high on Friday and logged its best week since February 2021.

- The S&P 500 is expected to show a growth rate of 21.7%, which would be the fourth straight quarter above 20%, according to FactSet.

- Speaking of inflation, a few people have mentioned the short and succinct Ben Carlson’s daily commentary from last week called Three Biggest Risks to The Markets Right Now, which included this table and quick commentary on inflation:

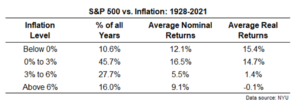

- The stock market is a great hedge against higher inflation over the long-run. It can be a decent hedge over the short-run but persistently high inflation is not great for stock returns. I looked back at calendar year returns for the S&P 500 going back to 1928 and compared them to different inflation regimes:

- You can see 0% to 3% is the sweet spot. Nominal returns are actually pretty good when inflation is running at 6% or higher but those returns are swallowed up by inflation when you look on a real basis. Last year was actually one of the best years on record with inflation running so high. The only time real returns were higher when inflation was 6% or more was in 1975.”

- But the aforementioned Ben Carlson article had another nugget in it which includes a great talking point and something to think about: “From April 2020 through the end of 2021, the S&P 500 was up 90%. That’s a massive return in a 21-month period. Just look at where it ranks for 21 month total returns going back to 1950. The only time it was higher was in the 1950s bull market. Guess what followed this nearly two-year boom? There was an 11% correction in a month in the fall of 1955. Then in the summer of 1956 stocks tumbled 15%. Less than a year later the only bear market of the 1950s commenced as stocks fell nearly 21%.”

Crypto Corner – Grant Engelbart, CFA, CAIA, Sr. Portfolio Manager

- Major coins suffered double-digit losses in the first week of 2022. Bitcoin fared the best but still fell almost 12% through Sunday night. Ethereum, Solana, Cardano, and Polkadot all fell 15-20% for the week. Chainlink, which functions as a connection between outside data and blockchain networks (known as an Oracle), rose almost 30%.

- Bitcoin celebrated a birthday this week. The first block was mined 13 years ago and the miner received 50 bitcoin as a reward – worth almost nothing at the time, and now over $2 million. Blockchain technology company BTCS announced this week they are paying a “Bividend” – the first public stock paying a dividend in Bitcoin. Matt Damon’s Crypto.com ad is catching more flack this week despite airing since October.

- The SEC delayed a decision on New York Digital Investment Group (NYDIG) ETF proposal, joining Bitwise and Grayscale proposals still awaiting a decision. They have until March 16, 2022. There have not been any digital asset-related ETF launches so far this year.

- This coming week’s guest on Orion’s The Weighing Machine podcast will be Brian Dobbis from Lord Abbett. In short, Brian is one of the leading experts on retirement planning in our profession. He prefers to call himself a “retirement geek” and it’s obvious he knows his stuff.

- “The most important investment you can make is in yourself.” Warren Buffett. Warren Buffett quotes.

- What are the best physical predictors of a long life?

- Dilbert’s Scott Adams on quick tips to be a better business writer. Seriously, Adams gets a lot of kudos from serious business folks.

- More short and very important tips from my favorite economist Tyler Cowen: 8 tips on watching movies.

- The year in cheer: 192 ways the world got better in 2021!

- Another awe-inspiring picture with snow and more — Northern Lights in Iceland.

- Thanks for reading and have a great week! For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com.

0064-OPS-1/11/2022

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.