Stock Splits 101

Once upon a time, stock splits were much more common as a means for companies with high-flying stock prices to attract new investors. According to data from the S&P 500 Index, there have been 45 stock splits (excluding reverse splits), on average per year since 1980. The maximum number of splits occurred in 1986, when there were 114 stock splits. However, this number has significantly decreased during the past few years, as the average number of stock splits per year has dropped to single digits.

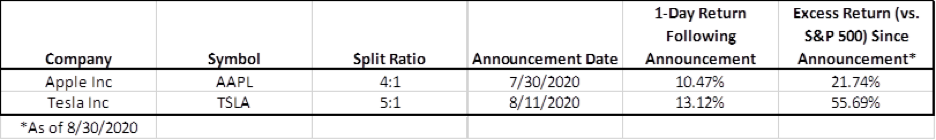

Perhaps this is why, when Apple made the announcement to split its stock 4-for-1 in late July, the market reacted very positively and stock price soared nearly 11% over the next trading day (full disclosure: Apple also had strong third-quarter results). As the old saying goes, “Good things come in pairs,” and Tesla followed suit shortly after, announcing a 5-for-1 stock split. Stock price increased more than 13% following the news. As of Friday’s close, both stocks have outperformed the S&P 500 by double digits since their respective split announcement.

Source: Morningstar Direct

To understand the logic behind the market reactions, let’s look at some of the reasons behind a company’s decision to do a stock split:

- As mentioned at the start of this commentary, perhaps the primary reason for a stock split is to lower the price of the stocks to make shares seem more affordable to small investors. Take Tesla, for example, which is trading around $2,000 per share. After the 5-for-1 split, the price per share will drop to $400 per share.

- Liquidity: The number of outstanding shares will be increased by the split ratio factor, and this typically increases the stock’s trading volume. The improvement in liquidity tends to narrow the bid/ask spread, which means lower trading cost when trading them. According to Nasdaq Economic Research, “Spreads improved by 23% while liquidity (measured as value traded) increased 14%.”

- Boost Performance: Multiple studies have shown average stock outperformance after the stock split. According to Nasdaq Economic Research, the average stock outperformed the S&P 500 Index by almost 5% after one year. A similar study by David Ikenberry, now Chairman of the Finance Department at the University of Illinois at Urbana-Champaign, indicates an even higher outperformance of 8%.

Despite the historical premium stock splits have provided, it’s important to remember that stock splits have no effect on the intrinsic value of the company. The net effect from increases in the number of outstanding shares and the decreases in price per share should have no impact on the market capitalization of the company—the premium is due to market inefficiency. However, as the investment industry continues to innovate with the launch of ETFs, and more recently, the offering of fractional shares, companies with high sticker prices are now easily accessible to investors of all sizes. Perhaps the premium from the stock split might not be as attractive as it has been in the past.

2301-OPS-9/2/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.