The Fast and Furious S&P 500

The U.S. stock market, as measured by S&P 500, recently returned to all-time highs. It’s still August – and so far this year we’ve seen the quickest bear market in stocks in history, and now, the quickest recovery. All of this amidst an ongoing global pandemic.

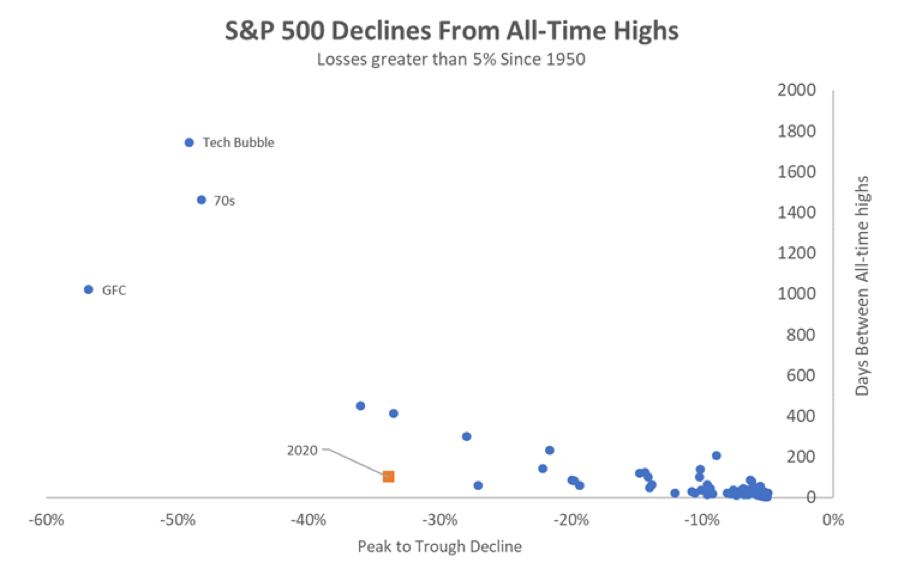

I keep asking myself, “Is the market moving faster?” and it definitely seems that way – but does the evidence back it up? First, I looked at the current loss and subsequent recovery, compared to all S&P 500 declines since 1950 (less than -5%).

As you can see in the chart, 2020 sticks out like a sore thumb. Similar size declines (in 1987 and 1968) took more than 400 days to return to an all-time high. Remember that blip back in June, a one day drop of 6%? Stocks rebounded in a couple of weeks, about half the time it normally takes for corrections to recover. So far, it seems like speed is a defining feature of this market.

Source: Bloomberg

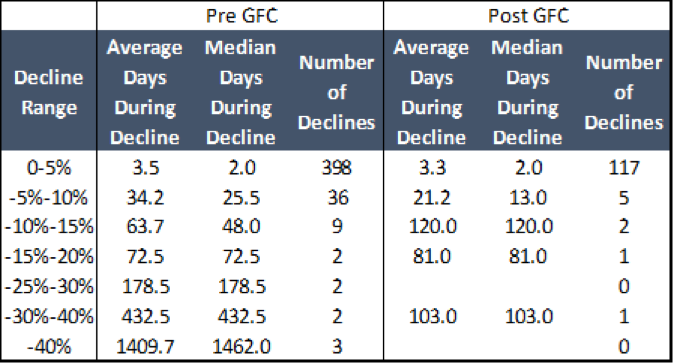

Looking through the history of declines going back to 1950, we can make some comparisons. I looked at declines pre-and post-Great Financial Crisis of 2008-2009 (“GFC”). Results are in the table below, and they aren’t quite what I expected. There is some evidence that more shallow corrections (10% or less) have happened and recovered faster in recent times than prior to the GFC. However, there are only five examples of declines between -5% and -10% since the GFC, not quite statistically significant. Larger declines, -10% to -15%, have actually taken longer to recover than they did pre-GFC. But again, there are only two instances of this happening (2016 and 2018).

Source: Bloomberg

All in, each decline is different – in circumstance, length, and depth. More needs to be done to definitively say that markets are faster than ever. Heck, in 1955 stocks fell 11% and recovered in one month, and in 1982 fell 27% and recovered in two! The point is, markets move fast, and maybe they always have. Trying to judge the best time to get in or out is always a messy proposition. Despite all of the issues and reasons the market could crash, it does always recover. Buying at all-time highs is as good a time as ever.

Want to stay on top of market volatility, trends, and developments? Check out our Market Volatility Command Center, featuring regularly updated market commentary and thought leadership from our strategist partners and Investment Team. Click here to view and subscribe.

2245-OPS-8/27/2020