Tuesday Morning Market Insights: Last Week in Review with Rusty Vanneman, Vol. 53

- Happy Tuesday. I hope you had a wonderful and restful long weekend – and that your NFL playoff teams are still alive!

- Losses in the new year continued last week with the overall US market seeing a small loss. Losses were led by growth stocks at over -1%, with value stocks outperforming at nearly +1% for the week. Also notable was a +2% gain from emerging market equities. Energy stocks were up over 5% for the week, continuing their strength for the year.

- Among diversifiers, bonds were essentially flat. Commodities were up over 2%, while diversified alternatives had a slight loss of -0.3%.

- No change last week in Ten Year Treasury Yields. They closed at 1.77%.

- To start this week, oil prices are up nearly 2% and trading above $88, a seven-year high. Also, the 10-year yield is up above 1.83%, its highest since January 2020.

- Why might have bond yields taken a breather last week? It could be argued the bond market needed to catch its breath after its recent sharp move. It could also be argued that the economic data softened. For instance, inflation data like Consumer Price Index (CPI) was in line with expectations (though core CPI was hotter than expected). Real wages fell over 2% year-over-year. The Retail Sales report on Friday was also a dud with misses across both core and headline measures.

- COVID data continues to significantly impact all of our lives and the absolute number of cases continues to swell to scary levels. Bright spots? This latest huge surge in cases has led to much less intensive healthcare outcomes than prior waves. According to The Wall Street Journal, Omicron is slowing in early U.S. hot spots, offering first hopes of a peak. Let’s hope so.

- Earnings season started. Of the 52 companies that have reported, just 60% have topped Earnings Per Share forecasts while 71% have exceeded sales forecasts. In terms of their outlooks, a net of only 5% of companies reporting has raised guidance (source: Bespoke Investment’s Weekly Bespoke Report.). These are still good numbers, though not as strong as prior quarters.

- There’s plenty of housing data on this week’s economic schedule, however, there are no reports this coming Friday.

- The current estimate for 4Q21 GDP continues to free-fall according to GDPNow. It is now at 5.0% (from 6.7% the prior week).

- Speaking of economic data, according to Bloomberg, every ETF listed in the US with the word ‘inflation’ in its name saw inflows in 2021.

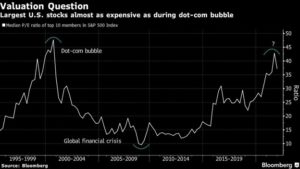

- Need an argument for diversifying? Last week in these bullets we wrote about how the top five names in the US stock market make up nearly 25% of the US stock market now. Here’s a chart showing the top 10 names in terms of valuations.

Source: @business via @alykhansatchu article: Bloomberg

- We write a lot about the Behavior Gap and why investors “chasing performance” is so detrimental. For example, did you know that Cathie Wood’s ARKK fund has a 4x return over its lifetime, has 4 stars according to Morningstar, and is the #1 ranked fund over the last 5 years, yet the average investor has lost money in ARKK? FYI — I note this and I’m a fan of Cathie Wood.

- Two different styles of investing: The Tortoise (Warren Buffett’s Berkshire Hathaway) vs The Hare (Cathie Wood’s ARK Fund)

- Most of us get this question all the time – are Target Date Portfolios appropriate for most investors? Not according to this article: TDFs Inappropriate for most investors. “Target-date funds are an appropriate investment for your retirement portfolio—if you’re an average investor. If you’re not—like most of us—you can do much better than the one-size-fits-all approach to equity allocations that target-date funds offer for your retirement portfolio.”

- Speaking of customization, here’s a great talking point to put in your back pocket regarding direct indexing. To set the stage, I am a big fan of ETFs. But, like everything they’re not perfect. In fact, because of their transparency around portfolio holdings and rebalancing dates, many hedgies and traders essentially anticipate ETF trades and disadvantage ETFs on average 15 bps (0.15%) a year in performance. This 15 basis point disadvantage is an advantage to customized portfolios using direct indexing which doesn’t have this performance drag.

- ETFs are still one of the greatest financial innovations ever in my opinion and 2021 proved to be a record year for ETFs according to Blackrock. “Not only did inflows across U.S.-listed ETFs nearly double the previous record, but numerous use cases and trends emerged that detail the importance of ETFs for investors accessing markets. From “meme stock” mania to the growth in sustainable assets, this year’s biggest trends played out in ETFs.”

Crypto Corner – Grant Engelbart, CFA, CAIA, Sr. Portfolio Manager

- Major cryptocurrencies gained last week (through Sunday night). Bitcoin held the $40,000 level and traded around $42,000 Sunday night, gaining just over 1% on the week. Ethereum tacked on almost 5%, Cardano (5th largest coin) gained over 40%, Solana 4%, Polkadot 9%, and everyone’s favorite, Dogecoin, added 20%.

- In news, the Fed plans to release a report on digital assets and Central Bank Digital Currencies (CBDCs) in the coming weeks, Ethereum volume on NFT platform Open Sea set a monthly record with two more weeks left, Tesla announced they would accept Dogecoin for certain merchandise purchases, and Centralized digital asset exchanges reported over $14 trillion in trading volume for 2021, a nearly 700% increase.

- ETF news was light last week. The waiting game on a physical Bitcoin ETF continues. Most Bitcoin ETFs were up just under 3% last week, and crypto-related equities rebounded around 2%.

- Digital assets continue to stir up attention, and so does the rollout of new digital assets ETFs. Want to learn more? How about learning a Digital Assets ETF Recipe from a portfolio manager with a specialty in ETFs and alternatives like digital assets? Join the January 25th Digital Assets ETF Portfolio Recipe

- This week’s guest on the Orion’s The Weighing Machine podcast will be long-time favorite Kim Arthur from Main Management. With his typical energy and enthusiasm, Kim provides us with his 2022 outlook. The interview is loaded with nuggets.

- “The question is not who is going to let me, but who is going to stop me.” Ayn Rand. Quote from this interview of Noreen Beaman in Real Assets Interview: The Road To Growth

- For all you MBAs who had to study Michael Porter, here’s a good reminder from Joachim Klement’s “Be Different” article last week: “…there are only three ways to be successful as a business: be cheaper, be better or be different.”

- Speaking of Klement, another short and sweet article of his last week: Efficiency makes you happy had a lot of cool nuggets, which included supporting Orion’s value One Orion regarding work/life balance.

- “They say people should work smarter not harder. If you become more productive at work (read: if you become a bit more German), you can go home earlier each day and spend more time with your family. And we know that spending time with family and friends makes people happier. Spending longer hours in the office doesn’t. Increasing your productivity at work has enormous benefits for your work-life balance and your personal happiness.”

- It is said that the greatest short story ever written was by Ernest Hemingway, which simply contained these six words: “For sale: baby shoes, never worn.” Five Tips to Master Social Media Writing.

- How many have you seen? 30 Movies That Are Basically Perfect.

- Ben and I like to think we are hunters of awesome and Ben found this awesome picture, cool topic, and potential screensaver: Orion’s Fireplace

- While we’re on the topic of awesome visuals, though I try to make things snappy on these weekly bullets, here’s a 10-minute video “The Most Insane Ski Run Ever Imagined” (for your next coffee break) that has nothing to do with work, but it’s a great pump-up for all the skiers (and snowboarders like me).

- Thanks for reading and have a great week! For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com.

- Have a great week!

0113-OPS-1/19/2022

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.