Weekly Market Bullets with Rusty Vanneman, CFA, CMT, BFA, Vol. 105

It was an entertaining Super Bowl Sunday night between two great teams. Arguably, the result came down to just a few big plays. One of the game’s highlights for me though was seeing the E*TRADE baby back. I used to “work with” him back in the day when I worked at E*TRADE. We would rotate our pictures on the front page of the E*TRADE website when I was publishing content. Needless to say, I lost miserably for attention and even saying that makes me sound more competitive than I was. Still, I missed him.

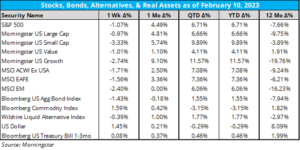

The “January Effect” is real, as the markets generally struggled again last week after the strong returns in January (Morningstar, Feb. 2023).

- The S&P 500 lost about 1%, led by losses in growth stocks (Morningstar, Feb. 2023). This was just the second weekly loss for the S&P 500 so far this year (Morningstar, Feb. 2023). It was the NASDAQ’s worst loss in nearly two months (Morningstar, Feb. 2023).

- International stocks were down nearly 2% but are still holding onto a 7%+ gain for the year (Morningstar, Feb. 2023).

- Looking at 12-month returns, the S&P 500 and aggregate bonds are still down about 8% (Morningstar, Feb. 2023). Value stocks and commodities are holding onto slight gains of under 2% (Morningstar, Feb. 2023).

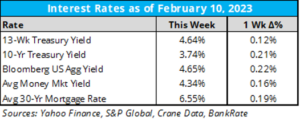

As for key rates last week:

- According to Bespoke Investment Group, the likely cause for the jump in rates (especially short term) is a bleak expectation for CPI next week (Bespoke, Feb. 2023). If the number comes in hotter than expected, the market is likely not going to be happy (Bespoke, Feb. 2023). Expectations for the Fed’s possible pivot to lower interest rates are also adjusting with many now expecting it to be later than earlier assumed (Bespoke, Feb. 2023).

Deeper Dive

The yield curve inversion we’re currently experiencing has now reached its deepest level since the 1980s (Bloomberg, Feb. 2023). Inversion between the 2-and-10-year treasury yields is generally seen as a standard recession indicator (Bloomberg, Feb. 2023). While it’s not perfect, and doesn’t cause downturn in and of itself, it does point to the disparity of outlooks for short versus long-term investors (Bloomberg, Feb. 2023).

As for the market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Group Fed Watch tool:

- 90% chance of 25 basis point increase on March 1 (CME Group, Feb. 2023).

- Decent odds of another 75 basis points from current levels (CME Group, Feb. 2023).

- Bottom line, expectations are shifting to the Fed moving rates higher than earlier expected, holding them at higher levels longer than expected, and not cutting rates until later (CME Group, Feb. 2023).

As many studies have shown, behavioral coaching can be one of the greatest value-adds that investors get from financial advisors. But how many advisors are implementing these practices? A graphic on “Financial Psychology Actions in the Planning Process” from Emily Koochel, PhD, AFC®,CFT-I™ was shared by our very own Chief Behavioral Officer, Daniel Crosby on LinkedIn on February 7, 2023. It looks at how many advisors are using psychology in their practices. I think it’s also important to note that many of these practices are not complex, and behavioral coaching doesn’t have to be complicated to have a positive impact on investors. Something as simple as establishing a lasting relationship with clients can have a net positive effect on our practices and on investor outcomes.

Did you know? Orion’s Due Diligence team last year took more than 50 due diligence trips (57 cities), spent 450 hours in manager meetings, added nearly 50 new strategies to the Orion Portfolio Solutions platform, and wrote nearly 200 research reports. Impressive.

- Our Investment Due Diligence Team is comprised of seven experienced and credentialed due diligence analysts

- 10 years of investment experience on average

- Three team members hold the CFA charter

- Three team members are currently CFA candidates

The AAII Sentiment Survey last week showed more bulls than bears for just the second time since the beginning of 2022, also ending the longest streak in net bearish sentiment since the survey’s inception (according to Bespoke Investment Group). The percentage of survey participants who are bullish also reached their highest level since December 30, 2021, though still below its historical average (AAII, Feb. 2023). As a contrarian indicator, as this survey tends to be, this could be an indication of lower risk-adjusted returns for the remainder of the year (AAII, Feb. 2023).

On Fred.StLouisFed.org, you can see a chart of the trend of consumer debt compared to the personal savings rate. While headlines continue to describe the cash position of consumers as strong, at least some of that strength can certainly be attributed to higher levels of debt (FRED, Feb. 2023).

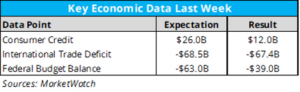

Economic data last week:

- It was a light week last week for economic data (MarketWatch, Feb. 2023). That will change this week (MarketWatch, Feb. 2023).

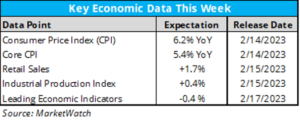

The economic data calendar is jam packed this week (MarketWatch, Feb. 2023). While most attention will likely fall on the Consumer Price Index (CPI) on Tuesday, we’ll also see retail sales, industrial production, and the index of leading economic indicators (MarketWatch, Feb. 2023).

- If CPI falls in line with consensus expectations at 6.2% YoY, this will be its lowest reading since October 2021 (MarketWatch, Feb. 2023). After an aggressive rate-hike cycle since March 2022, this slowing of CPI growth could be further justification for the expected rate-hike slowdown (MarketWatch, Feb. 2023).

Atlanta Fed’s GDPNow projection for first-quarter 2023 GDP jumped from the prior week’s reading from 0.7% to 2.2% on February 8, 2022. The jump seems to be caused primarily by an increased forecast in consumer spending (GDPNow, Feb. 2023).

An update on earnings from Factset Earnings Insights:

- Earnings Scorecard: For Q4 2022 (with 69% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise (Factset, Feb. 2023).

- Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -4.9% (Factset, Feb. 2023). If -4.9% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%) (Factset, Feb. 2023).

- Earnings Guidance: For Q1 2023, 58 S&P 500 companies have issued negative EPS guidance and 13 S&P 500 companies have issued positive EPS guidance (Factset, Feb. 2023).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Crypto prices took a breather last week, with Bitcoin falling 4% to under $22,000 (CoinMarketCap, Feb. 2023). Ethereum dropped 5%, Solana fell 6% and Polygon jumped 7% on the week (CoinMarketCap, Feb. 2023).

- Large crypto exchange Kraken reached a settlement with the SEC regarding staking, and will no longer offer the service to US customers (Decrypt, Feb. 2023). Coinbase’s CEO seems to think the SEC will come down on all US staking services (Decrypt, Feb. 2023). Long-running crypto exchange LocalBitcoins is closing down (Decrypt, Feb. 2023). The California DMV is working on a project to put car titles on the Blockchain (Decrypt, Feb. 2023)!

- Digital Currency Group is selling holdings in several investment vehicles at Grayscale to deal with the bankruptcy of Genesis (both owned by DCG) (Coindesk, Feb. 2023). There is an Ethereum token launched this week that tracks 1:1 a UK based ETF; that ETF tracks the S&P 500 (Decrypt, Feb. 2023).

Additional Resources

“Wherever we are, whatever we’re doing and wherever we are going, we owe it to ourselves, to our art, to the world to do it well.” ~ Ryan Holiday (GoodReads, Feb. 2023).

On this week’s Orion’s The Weighing Machine podcast we talk to Senior Portfolio Manager Paula Wieck from Commerce Trust Company. A dear friend, who spent nearly 12 years at Orion before going to Commerce, Paula talks to Robyn and me about a range of topics, including her outlook, her favorite resources/slides for talking to investors, tips for getting into the industry, what’s it like to be a woman in an industry (that arguably should have a lot more female investment counselors and managers), and a lot more!

Bespoke on ChatGPT: “A single event watched simultaneously on TV by 40% of the US population will never be duplicated again, but the stampede of Chat GPT into the mainstream is an event unrivaled by any other product in history. According to a study by UBS, Chat GPT reached 100 million monthly active users in the span of two months putting it years ahead of Google Translate (78 months), Uber (70 months), Spotify (55 months), and Instagram (30 months). Even TikTok took nine months to reach that milestone! Chat GPT is to consumer tech what the Beatles were to music. It will leave a permanent impact on society in terms of how people gather, produce, and consume information and who knows what else. The only question is whether it will be the AI tool we’re still talking about years from now, or will it burn out and allow others to fill the void? Just yesterday, Google launched its own AI technology called Bard to public testing, and according to Bloomberg, Baidu (BIDU) will launch its own service similar to Chat GPT by March.”

While ChatGPT is getting a lot of attention, there are lots of other AI tools out there to explore! There’s a great list posted by Nikhil Gaddam on LinkedIn two weeks ago.

Steve Jobs on why AI will make us more creative (Billy Oppenheimer Tweet on February 8, 2023).

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at www.orionportfoliosolutions.com/blog.

0447-OPS-2/13/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.