Weekly Market Bullets with Rusty Vanneman, CFA, CMT, BFA, Vol. 107

Greetings from Orlando and the Orion Ascent Conference. Should be a great week here in Florida and let’s hope the markets agree after last week’s losses of 3% as the inflation numbers keep surprising to the upside and expectations start to shift toward higher interest rates again (Morningstar, Feb. 2023).

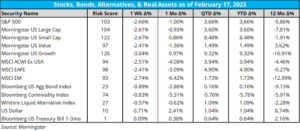

Regarding performance last week, it was the worst week of the year for the S&P 500 and the Nasdaq (Morningstar, Feb. 2023). It was the third consecutive weekly loss for the S&P 500 (Morningstar, Feb. 2023).

- Despite the recent losses, the strong January gains have still propped up the year-to-date returns for all asset classes, except for commodities (Morningstar, Feb. 2023).

- We added something new to the scorecard this week: the estimated Orion Risk Scores (ORS).

- The ORS means the risk relative of an investment compared to the global equity market. It’s essentially computed using the relative price volatility of the index versus the global equity market.

- Regarding the ORS, it may surprise some people that the US based S&P 500 has a higher Orion Risk Score (103) than non-US stocks as defined by the MSCI ACWI (Ex-US) (94). Why? A leading reason is because the US stock market currently has more exposure to growth stocks (126) which have higher volatility than value stocks (97), at least when looking at US stocks. I would also argue that increased diversification (especially between different economies and currencies) for non-US is also a factor.

(Click on the chart to see a larger view)

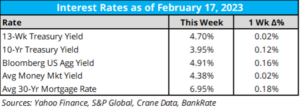

As for key rates last week:

- It was another week of higher rates, with mortgage rates up another 18 basis points (Bankrate, Feb. 2023).

- Yields are starting to hit new highs in many maturities according to Strategas: “2-year yields start the week at fresh cycle highs, joined by a robust list of countries that can make the same claim – Germany, Australia, Canada, China, France, Italy, Spain, Ireland, Greece, Portugal, Norway, Netherlands, Sweden, Finland, Denmark, Belgium, Austria, New Zealand, India, Mexico and Singapore (22 in total).” (Strategas, Feb. 2023)

- More from Strategas:“Along with short rates, U.S. breakeven inflation is also surging again – 2-year breakeven rates are up more than +100bps over the last month, but curiously without any help from Crude this time.” (Strategas, Feb. 2023)

Deeper Dive

As for the changing market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Group Fed Watch tool:

- There is now projected to be 70% chance (down 20% last week) of a 25 basis point increase on March 22; 30% of a 50 basis point increase (CME Group, Feb. 2023).

- It’s still mostly expected that the Fed will stop after increasing another 75 basis points from current levels (CME Group, Feb. 2023).

- That said, there are increasing odds for rates to still go up another 150 basis points (CME Group, Feb. 2023).

- Bottom line, expectations are shifting to the Fed moving rates higher than earlier expected, holding them at higher levels longer than expected, and not cutting rates until later (CME Group, Feb. 2023).

Given last year’s losses, valuations for US stocks have clearly improved, but they’re still high by historical standards (Bloomberg, Standard & Poors, Feb. 2023). For example, “The Price/Sales Ratio for the S&P 500 is as high as was at prior market peaks” (Hussman Funds, Feb. 2023).

There is opportunity for better returns in other markets besides the S&P 500. For example, Vanguard sees non-US stocks outperforming “by 2% per year for the next 10 years” (Financial Advisor Magazine, Feb. 2023).

Two of my favorite annual reads came out last week:

- The 2023 Credit Suisse Global Investment Returns Yearbook (Abnormal Returns, Feb. 2023). This is an annual update to one of the greatest financial advisor coffee table books, the “The Triumph of the Optimists” by Elroy Dimson, Paul Marsh, and Mike Staunton, with data that includes inflation-adjusted returns for all the major (and some not-so-major) markets around the world back to 1900. Below is the US experience.

- Since 1900, stocks have returned 6.4% above inflation, while bonds have returned 1.7% more, and cash has had a return of 0.4% above inflation (Dimson, Marsh and Staunton, Feb. 2023).

- Berkshire Hathaway’s annual shareholder letter, which included a bunch of nuggets from BRK’s Warren Buffett in 10 pages, including a few nice quotes from his partner Charlie Munger:

- The world is full of foolish gamblers, and they will not do as well as the patient investor. (Berkshire Hathaway, Feb. 2023)

- Early on, write your desired obituary – and then behave accordingly. (Berkshire Hathaway, Feb. 2023)

- Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time. (Berkshire Hathaway, Feb. 2023)

- Ben Graham said, “Day to day, the stock market is a voting machine; in the long term it’s a weighing machine.” If you keep making something more valuable, then some wise person is going to notice it and start buying. (Berkshire Hathaway, Feb. 2023)

“Retirees lost 23% of their 401(k) savings in 2022, Fidelity says” in a CNBC article from February 23, 2023.

So, how much do people think they need to retire? Most think $3 million or more to retire comfortably (A Wealth of Common Sense, Feb. 2023).

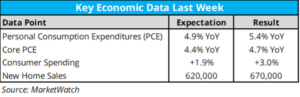

Economic data last week:

- The big number last week was Personal Consumption Expenditures (PCE) (First Trust, Feb. 2023).

- The overall PCE deflator (consumer prices) rose 0.6% in January and is up 5.4% versus a year ago (MarketWatch, Feb. 2023). The “core” PCE deflator, which excludes food and energy, also rose 0.6% in January and is up 4.7% in the past year (MarketWatch, Feb. 2023).

- According to First Trust:“Income, spending, and inflation all rose in January, adding to the growing cache of data confirming that the Fed’s job is not done.” (First Trust, Feb. 2023).

Ever hear the expression “financial conditions”? From John Auther’s February 22 article in Bloomberg, “Fed Minutes Show Three Weeks Is a Long Time”, a common definition of financial conditions includes what is happening in market prices for stocks, credit, and oil prices. Currently, financial conditions are getting a bit tougher again (Morgan Stanley Research, Feb. 2023).

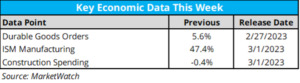

The economic data calendar cools a bit from last week (MarketWatch, Feb. 2023).

Atlanta Fed’s GDPNow projection for first-quarter GDP is now at 2.7%. If true, not a bad number for the top concern being recession entering the year.

An update on earnings growth from the latest Factset Earnings Insight (Feb. 2023):

- Earnings Scorecard: For Q4 2022 (with 94% of S&P 500 companies reporting actual results), 68% of S&P 500 companies have reported a positive EPS surprise and 66% of S&P 500 companies have reported a positive revenue surprise (Factset, Feb. 2023).

- Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -4.8% (Factset, Feb. 2023). If -4.8% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%) (Factset, Feb. 2023)

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Crypto prices cooled last week, with Bitcoin falling 4% to $23,500 and Ethereum dropping 3% to near $1,600; most other major coins dropped as well (CoinMarketCap, Feb. 2023).

- Coinbase (COIN) stock reported earnings last week, beating expectations (Decrypt, Feb. 2023). Coinbase also announced the formation of their own layer-2 blockchain called Base (Decrypt, Feb. 2023). Block (SQ) also reported earnings, missing expectations, and the company’s Bitcoin related revenue fell 25% y/y (Decrypt, Feb. 2023). The ban on crypto trading in Hong Kong is likely being lifted soon (Decrypt, Feb. 2023). Canadian crypto exchanges have 30 days to register with the company’s financial regulator (Decrypt, Feb. 2023).

- No new digital asset ETF news this week (ETF.com, Feb. 2023).

Additional Resources

“What you do on your ordinary days determines what you can achieve on your extraordinary days.” ~ James Clear (Goodreads, Feb. 2023).

On this week’s Orion’s The Weighing Machine podcast we talk to Eric Biegeleisen from 3Edge Asset Management. The experienced investment personnel for 3Edge comes from the once leading ETF strategist Windhaven (and Windward). 3Edge specializes in the tactical investment of ETFs, and both facts come through on this interview.

Speaking of podcasts, Orion’s latest monthly Weighing The Risks podcast is out this week. This month, we explored different scenarios regarding China’s re-opening after Zero Covid. China’s re-opening could be on the short list for the big events of 2023, and in this podcast we talk to one of the leading U.S. based experts on the Chinese economy and markets, Brendan Ahern, the CIO of KraneShares.

Speaking of content, how about last week’s webinar on Orion Portfolio Solution’s (OPS) “Easy Button” Market Cycle Advised Mandates (MCAM) portfolio? “Now with three years of track record, the Market Cycle Advised Mandates (MCAM), portfolios are designed to help guide your clients to the right portfolio based on their unique risk tolerance, market participation attitudes, and investment goals. MCAM delivers actively managed, UMA portfolios that align with investor expectations and embody our three-mandate investment process. Hear how you will find allocations that are representative of the models, strategists, and characteristics that are broadly found on the OPS platform in one ‘easy button’” within each portfolio.”

According to “The Inflation Guy” Michael Ashton in his February 22, 2023 blog post: “Now, because miles are money, your best strategy is to spend them as quickly as you can. They don’t earn interest, so they are a wasting asset in real space.”

John Templeton Foundation’s A Conversation With Professor Robert Waldinger on ‘The Good Life: Lessons From the World’s Longest Scientific Study of Happiness’: The study’s number one takeaway is that good relationships, from casual social interactions to life partnerships, make us happier, healthier and lead to living longer.

The place to be this week: Orlando!

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at www.orionportfoliosolutions.com/blog.

0633-OPS-2/28/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The unaffiliated strategists whose funds or models are utilized pay Orion Portfolio Solutions (OPS) a fee in exchange for inclusion in the Market Cycle Advised Mandate (MCAM) Portfolios. Additionally, we utilize the Destination Funds, which are mutual funds managed by our affiliate Brinker Capital Investments, in the portfolios.

Further, each Strategist may expect that a portion of the total assets in the portfolios be allocated to their funds or models. To mitigate the conflicts, OPS manages the portfolios based upon their investment objectives, our long-term capital-forecasts, and your risk score. Further, you and your Investment Advisor, not OPS, are responsible for selecting the most suitable portfolio for you. OPS does not provide advice or recommendations regarding portfolio selections.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.