Weekly Market Bullets with Rusty Vanneman, CFA, CMT, BFA, Vol. 109

Fascinating weekend, wasn’t it?

Did the Federal Reserve finally “break something”? It looks like it did. The notion is that the Federal Reserve will continue to raise short-term interest rates to bring inflation back down unless something “breaks” in the financial system. Then they might stop. With the closure of Silicon Valley Bank (SVB), that might have happened – or not. There’s a lot to unpack here, and it’s a fluid situation, but let’s see if we can bullet-ize the situation into digestible talking points. Note, the following was originally written Saturday, re-written yesterday, and changed again Monday morning. If given the opportunity, I’m sure I would change it again by the end of the day.

Silicon Valley Bank (SVB) Bullet points:

- For starters, Orion is putting our various resources on this matter in the very near-future. Stay tuned.

- Some of the analysis includes work from Josh Flade, who used to cover banks at Goldman Sachs.

- Given the moves over the weekend, the situation now looks manageable, at least in the near-term (CNBC, Mar. 2023).

- SVB’s situation was arguably manageable, but there remains the risk it could become a much larger issue for the banking community (CNBC, Mar. 2023).

- The markets are a mosaic of human behavior; trust and confidence are key (CNBC, Mar. 2023). The information that investors hear and read, and the sources and the motivations (and vested interest) of those sources, however, can influence and change that trust and confidence (CNBC, Mar. 2023). Things can change fast, and they did (CNBC, Mar. 2023).

- For example, Silicon Valley Bank (SVB) early last week seemed like a strong company, and by week’s end was shut down by regulators inthe biggest bank failure since the global financial crisis (CNBC, Mar. 2023).

- What happened? SVB basically had a “bank run” where their customers pulled their deposits faster than SVB could pay them (CNBC, Mar. 2023).

- SVB’s clientele was focused on the Venture Capital (VC) sector supporting start-ups (CNBC, Mar. 2023).They were big accounts, and SVB wasn’t super diversified in terms of clientele (CNBC, Mar. 2023).

- Last Wednesday, Silicon Valley Bank was indeed considered a well-capitalized institution seeking to raise some funds, according to the bank’s mid-quarter update (CNBC, Mar. 2023).

- Within 48 hours, a panic was created by the very venture capital community that SVB served over the bank’s 40-year-run (CNBC, Mar. 2023).

- “This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor of Restive Ventures told CNBC (CNBC, Mar. 2023).

- SVB had a few other problems, which other banks still share – and an issue that remains for the banking industry (CNBC, Mar. 2023).

- First, the core business model for banks (though their revenue streams are much more diversified than this now) is to borrow short (i.e., the interest you get paid on your deposits at the bank) and lend long (i.e., the amount you pay on your debt to the bank, like mortgages) (CNBC, Mar. 2023). With the yield curve inverted (short term rates higher than long term rates), that’s not a way to make money, but lose it (CNBC, Mar. 2023).

- In addition, many banks are not paying higher short-term rates yet, thus creating competition for short-term assets (CNBC, Mar. 2023). Money has been flying into non-bank savings accounts (CNBC, Mar. 2023). Short-term ETFs are one example (CNBC, Mar. 2023).

- Another problem is that when banks need to sell down some of their portfolios, they need to sell longer-term bonds (CNBC, Mar. 2023). Given how much interest rates went up last year, these bond holdings need to be sold at losses (CNBC, Mar. 2023). That doesn’t help bank profits, which in turn prompts more clients/investors to leave the bank (CNBC, Mar. 2023).

- Note: the government is now stepping up to make sure banks don’t have to realize those losses if they need to sell them for liquidity reasons (CNBC, Mar. 2023).

- The Bottom Line quote from Sevens Report Research’s Tom Essaye:

- “Bottom line, I appreciate the bad memories that the Silvergate and Silicon Valley Bank headlines stirred up, and I appreciate the ‘sell now ask questions later response.’ But this is not 2007. The crypto industry is not the national housing market, and bank capital rules and reporting requirements are far different than they were in the mid-2000s.” (Yahoo Finance, Mar. 2023)

- What happens next? It’s a fluid situation, of course, and the facts/views can change as a result. As for now though, at least in the short term, price action will be volatile (CNBC, Mar. 2023). Thus, there will also be opportunity (CNBC, Mar. 2023).

- Given how much short-term rates dropped in recent days, and even Monday morning, they won’t likely go much lower given that economic and inflation data remain stronger than most expected at this point (CNBC, Mar. 2023).

- Nice overview article on SVB in Vox: 9 questions about Silicon Valley Bank’s collapse, answered.

- Read this Investec post from June 2020: Daniel Crosby: Investing rules for uncertain times.

Deeper Dive

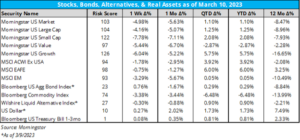

Regarding over-all performance last week:

- The US market lost nearly 5% (Morningstar, Mar. 2023).

- Given the losses particularly in regional banks, small caps lost nearly 8% and value stocks lost over 5% (Morningstar, Mar. 2023).

- Bank stocks had their worst week since March 2000 (Morningstar, Mar. 2023).

- The bond market, however, gained nearly 1% (Morningstar, Mar. 2023).

(Click on the chart to see a larger view)

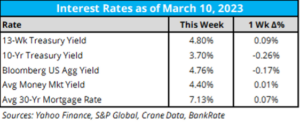

As for key rates last week:

- Along with overall markets, the 10-Yr Treasury yield slid on Friday as investors sought safety off the Silicon Valley Bank news (Barrons, Mar. 2023).

- Unfortunately, the average 30-year mortgage rate continued to rise last week, the fifth consecutive weekly rise off being near 6% in early February (Yahoo Finance, Mar. 2023). According to Freddie Mac’s estimates, the average was at 3.85% a year ago (Yahoo Finance, Mar. 2023).

- Earlier last week, before 2-year yields plummeted, the2s/10s yield curve was the most inverted since 1981 (The Wealth Advisor, Mar. 2023). Needless to say, 2s have been in an absolute free-fall since then (Yahoo Finance, Mar. 2023).

By the end of last week, according to a March 10 tweet by Jim Bianco, president of Bianco Research, “…the 2-year was down 44 bps over the last two days (since Wed’s close). Only four other days in the last 40 years have seen larger two-day moves. Oct 20, 1987, = the day after the largest stock market crash in history (-22%, Oct 19, 1987) Sept 14, 2001, = two days after the 9/11 terror attack Sept 15, 2008 = the day Lehman failed Sept 29, 2008 = two days after the failed TARP vote. These are all epically important days in market history. (Was Friday) really in their league?”

More from Bianco, this time comparing the interest banks are paying vs other cash substitutes: “Over the past year, banks kept rates on checking/saving accounts extremely low compared to MM funds. The avg yield on a MM (blue) reached as high as 4.43% recently, while bank rates (orange) remained at just 0.48%. The gap was almost 4%.” (Jim Bianco, Mar. 2023)

Guess what Wall Street was thinking about SVB not that long ago: “Not a single sell rating”! Per Peter Mallouk’s tweet on March 10.

As for the changing market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Group Fed Watch tool:

- Note that this data has changed fast – even early Monday morning.

- The market is now thinking there is as 25% of NO hike on March 22(up 25% just over the last 24 hours), and a 75% chance of a 25 basis point move (up 5%) (CME Group, Mar. 2023). The chance of a 50 basis point increase went from a 30% to 0% chance over the last few days (CME Group, Mar. 2023).

From BeSpoke Investments (as of March 10, 2023): In short, the Fed keeping short-term rates “higher for longer” took a massive hit. Look at January 2024 Fed Funds expectations. Last Wednesday, the market was expecting 5.44% (BeSpoke, Mar. 2023). On Friday, it dropped to 4.73% (BeSpoke, Mar. 2023). Note – these numbers have changed even more as of Monday morning – but the point remains the same.

TINA is Dead, sort of. TINA is “There Is No Alternative”, an investing reference for when interest rates were so low, there was no alternative to investing in stocks (Wikipedia, Mar. 2023). Well, now with short-term interest rates so much higher, there is.

- Crudely, one could consider Treasury yields a hurdle rate for investing.

- For example, yields for the next year are 5% for Treasuries, give or take (YCharts, Mar. 2023). While I would argue that money for near-term liabilities shouldn’t be exposed to stock market risk anyway (even when rates were near 0%), a 5% yield makes a compelling case for keeping that safely invested in cash.

- Going out 10, or even 30 years though, the current yield is 3.75% (YCharts, Mar. 2023). Given that the historical experience of stocks generating returns is closer to8-10%, I would say TINA still exists for maintaining a long-term equity orientation (YCharts, Mar. 2023).

- Since TINA was an early political reference to the former British Prime Minister Margaret Thatcher, here’s a song that’s also a play on “TINA is dead” and Maggie Thatcher: The Smith’s “Queen Is Dead” (which I did see performed live at Great Woods in Boston back in the ‘80s on a foggy, misty, magical evening).

Though they were hit hard last week, small caps remain relatively cheap, but did you know that:

- Small caps are the only asset class to outperform inflation in every decade going back to the 1930s (Strategas, Mar. 2023). More importantly, and drawing parallels to today’s environment, small caps handedly outperformed their large cap peers by +500 basis points on an annualized basis during the inflationary ‘70s (Strategas, Mar. 2023). However, they did slightly underperform large caps in the ‘80s while inflation was still elevated, albeit by a smaller margin than their outperformance in the ‘70s (Strategas, Mar. 2023).

If small caps are outperforming, that creates a tailwind for many active managers. Which, by the way, “Actively Managed Funds Did Better Than Usual in 2022” (Financial Advisor, Mar. 2023).

Vanguard published a new white paper for February 2023, “Commodity investing and its role in a portfolio”:

- Commodities is one of the least understood asset classes – this paper demystifies commodity investing by taking a deep dive into its returns, diversification benefit, and link to inflation (Vanguard, Feb. 2023).

- Incorporating commodities may improve investors’ outcomes and add more resilience to a portfolio (Vanguard, Feb. 2023). For inflation-hedging portfolios that require exposure to assets with high sensitivity to inflation, commodities can effectively help mitigate inflation risk (Vanguard, Feb. 2023).

- Commodities can play an important role in a goals-based inflation beta target strategy, an approach that immunizes a strategic portfolio to inflation with a specified inflation beta (Vanguard, Feb. 2023). For investors who target wealth growth, nonstatic, time-varying portfolios can vary the optimal level of commodities based on the economy and inflation (Vanguard, Feb. 2023).

Strategas research on the strong flows into “cash-like” ETFs:

- “As for bonds, cash-like ETFs have scored over $11 Bn inflows over the last two weeks, to accompany the 5% rate on 6-month T-Bills. Assets in money market funds have also surged to a new high of nearly $5 trillion. On the run and target duration products, a relatively new segment, continue to grow quickly with over $1 Bn AUM today. It’s still early in the year, but Fixed Income flows are greater than equities – another display of how much the current environment has changed compared to the QE era.” (Strategas, Mar. 2023)

ETF flows have really been the flows story in recent years, even when over-all investor demand has been down, ETF inflows and net flows have been strong (ETF Think Tank, Mar. 2023). Here are some Industry KPIs from the ETF Think Tank.

- One huge take-away. Most think ETFs are just big blocky beta market exposure (ETF Think Tank, Mar. 2023). That’s not really the case now, as non-traditional index (factor-based, etc.) and active are now nearly 60% of the industry’s revenues (ETF Think Tank, Mar. 2023). With more big-name investment firms entering the industry (think DFA, Cap Group, and more), this trend will likely continue (ETF Think Tank, Mar. 2023).

- This also means the “race to zero” is probably over (ETF Think Tank, Mar. 2023). Yes, investors want low costs, but they really want reasonable costs (ETF Think Tank, Mar. 2023). If an investment has a higher expected return (or better service and best yet both), investors will prefer that (and rightfully so) over the cheapest product possible (ETF Think Tank, Mar. 2023).

Speaking of flows, in case you missed this article, Orion hired a rainmaker! (RIAbiz, Mar. 2023)

Did you know? I bet you did on this one. Orion Portfolio Solutions (OPS) has long been known for having advisor-friendly Boutique and Emerging investment strategists to work with.

- While 85% of the industry’s assets are in Brand size firms (Morningstar, Mar. 2023), OPS only has half of that.

- While the industry has 14% of its AUM in Boutique firms (Morningstar, Mar. 2023), OPS has 44%.

- While only 1% of the industry is in Emerging firms (Morningstar, Mar. 2023), only 13% of OPS’s assets are.

The latest on investor sentiment and what it means for the market. Using the latest numbers from AAII Sentiment, the Bears outnumbered the Bulls by 17% last week.

- According to data from Orion’s analyst Nate Meister, that historically has suggested an above-average return for the next week, month, 3-months, 6-months, and year.

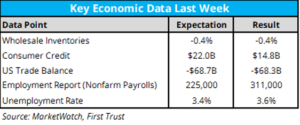

Economic data last week, according to First Trust’s “February Employment Report”:

- Nonfarm Payrolls- The unemployment rate rose to 3.6% from 3.4% in January, but that was due to positive news: an increase in the labor force (people who are either working or looking for work) of 419,000 (First Trust, Mar. 2023). The labor force participation rate (the share of adults in the labor force) is now 62.5%, the highest since March 2020 (First Trust, Mar. 2023).

- Two more key points about the labor situation. First, the recent unemployment low was a 52-year low in unemployment rate (First Trust, Mar. 2023). Will unemployment spike up fast? Could, but probably not. The job openings/unemployed ratio is holding near 2 (First Trust, Mar. 2023).

A big reason why inflation likely won’t significantly drop soon according to the The Inflation Guy, Michael Ashton: it’s because it’s not likely housing/rents will drop significantly (at least until more homes are built) (E-piphany, Mar. 2023).

- “This is not to say that higher interest rates have not affected economic activity, and this (to me) is the real surprise: given the amount of leverage extant in the corporate world, it amazes me that we haven’t seen a more-serious retrenchment. Some of this is pent-up demand that still needs to be satisfied, for example in housing where significant rate hikes would normally dampen housing demand substantially and seems to have. However, there is a severe shortage of housing in the country and so construction continues (and home prices, while they have fallen slightly, show no signs of the collapse that so many have forecast).” (E-piphany, Mar. 2023)

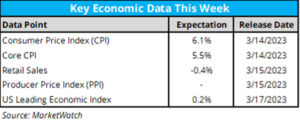

Here is the economic data calendar for this week:

- CPI and core CPI will be released on Tuesday; the expectation is for a YoY increase in headline CPI 6.1% which would represent its lowest level since September 2021 (MarketWatch, Mar. 2023).

- Consensus forecasts are calling for CPI to rise 6% over last year on a headline basis and 5.5% on a “core” basis in February, according to data from Trading Economics (Mar. 2023). A 6% increase in inflation would mark the slowest annual increase in consumer prices since September 2021 (MarketWatch, Mar. 2023).

Atlanta Fed’s GDPNow projection (as of March 8, 2023) for first-quarter GDP is now at 2.6% (up 0.3% over the last week).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Cryptocurrency prices dropped last week, with Bitcoin falling 6.5% to hover around $21,000 as of Sunday (CoinMarketCap, Mar. 2023). Ethereum fell 3% to near $1,500 (CoinMarketCap, Mar. 2023). Stablecoins were moving more than they should last week, with USDC dropping below its peg on worries about SIVB exposure, and UST moving up 1% as investors move assets (CoinMarketCap, Mar. 2023).

- The parent company of Silvergate Bank (SI) officially announced it was shutting down operations of the crypto-focused firm (Decrypt, Mar. 2023). As this was occurring, concern quickly spread to Silicon Valley Bank (SIVB), a less-crypto focused bank but still with significant exposure to VC companies in the crypto space (Decrypt, Mar. 2023). The company was halted Thursday and in the process of being unwound, with the FDIC stepping in and returning funds to depositors (Decrypt, Mar. 2023). The CFTC claimed this week that Ethereum is a commodity, contrasting SEC statements (Decrypt, Mar. 2023).

- Silvergate was widely held in a number of digital asset focused ETFs, but generally not more than 1% of most funds (Blockworks, Mar. 2023). SIVB is a much larger company but typically not considered a crypto pure-play and therefore not held in the majority of digital asset ETFs (Blockworks, Mar. 2023).

Additional Resources

“The stock market is the best economist I know.” ~ Stanley Druckenmiller (Wikipedia, Mar. 2023).

On this week’s Orion’s The Weighing Machine podcast we talk to Eric Godes, who is an SVP and senior consultant at FP Transitions. We talk about the latest trends in M&A among financial advisors. We also drill down on internal succession plans. Eric and I do go way back, having worked together for nearly a dozen years, including co-managing a multi-billion-dollar RIA in the Boston area for several years. Eric provides a rock-solid interview, and even surprised me toward the end of the conversation, including a view on “anti-mentors”.

What is the common thread between all strategies at Orion? It’s the due diligence that comes out of Chris Hart’s team. Check out his podcast from last week – and I bet you’ll forward this one. Podcast link: Why Due Diligence Is Critical for Successful Investments with Christopher Hart.

It’s that time of year – March Madness. Here are some tips on investing and picking your NCAA bracket from CLS Investments alum Scott Kubie: Don’t Invest your portfolio like you pick your NCAA bracket (Orchard Alliance, Mar. 2023).

A new Weighing the Risks podcast came out early Monday morning on Artificial Intelligence and what it might mean the economy and markets. Is it just the latest buzz, or it will AI meaningfully change productivity in the economy? Jay Jacobs provides some useful talking points and helps with various scenarios on how this can all play out.

We all know sleeping enough makes us healthier, but did you know that if you sleep more that you’ll also likely make more money! (Klement on Investing, Mar. 2023)

Check out the thoroughly awesome video that happened six years ago now, tweeted by @Phil_Lewis_ on March 10, 2017. It’s market-related (though stale), and you’ll laugh remembering it!

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at www.orionportfoliosolutions.com/blog.

0743-OPS-3/14/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.