Technology and Process Enhancements to Support a More Robust Investment Experience

Orion Portfolio Solutions is thrilled to announce the launch of multiple technology and process enhancements, designed to help instill greater clarity, accuracy, and support into your investment experience – key factors to building trust in the advisor-client relationship.

What You’ll See in the July Build:

-

An Improved Proposal Generation System:

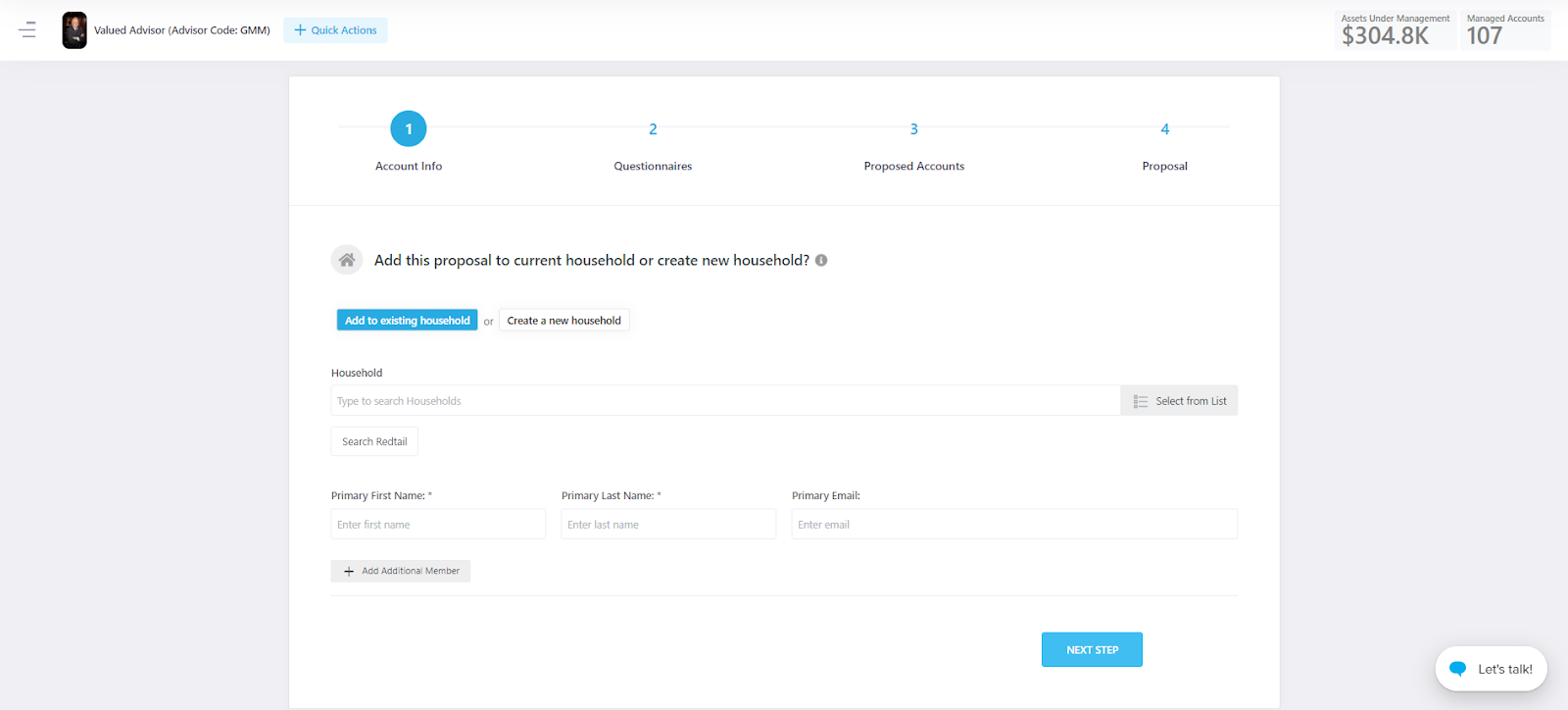

We understand that your ability to win and subsequently onboard new clients is essential to growth. To empower business development success, Orion Portfolio Solutions has long supported advisors with a step-based proposal generation process—one that makes building well-diversified UMA portfolios easy. Through the July release, we’re enhancing the step-by-step proposal framework advisors have come to love, with a modernized user interface, more robust asset allocation dashboard, and more flexible proposal delivery options.

Modern Design – The new proposal system delivers familiar step-based guidance featured in our legacy system, but with an improved user interface. The new design is created to further assist a smooth and intuitive proposal workflow, where working through each component of portfolio design becomes second nature. The new proposal system will also serve as a better reflection of the Orion brand, both in the proposal generator and end documentation.

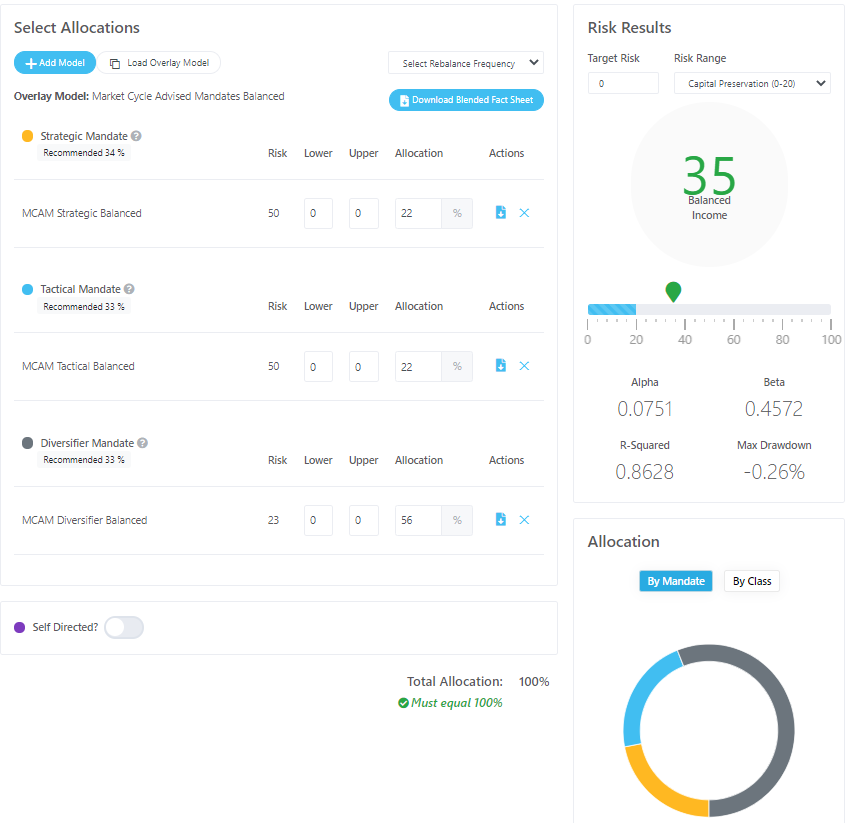

Robust Investment Selection – The investment selection dashboard has been enhanced to help you find, evaluate, and implement investment solutions with greater flexibility and confidence. The dashboard will provide greater proposal risk details, including real-time updates to:

- Alpha

- Beta

- R-Squared

- Max Drawdown

You will also see an expanded mandate allocation summary. Now, you can review asset allocation percentages by both mandate and asset class, via simple toggle functionality.

Furthermore, the proposal system now features a more fluid connection between UMA, single strategy, and self-directed proposals. Instead of choosing a rigid proposal type upfront, you can adjust your proposal with complete flexibility on the fly. For a single strategy proposal, simply allocate one strategist to the portfolio. For a UMA, assign additional strategies to each mandate. Want to add a self-direct sleeve to your UMA portfolios? Simply toggle the self-directed sleeve on and add your tickers, which will be incorporated into the proposal.

Proposal outputs can be selected, by template, to match your proposal structure.

Enhanced Proposal Documentation -The proposal documentation options available to you have been revamped to increase both flexibility for you, and the experience of your clients. Similar to the investment selection dashboard, proposal outputs can be selected and adjusted with increased flexibility. Instead of one option, you will be presented with various proposal templates (UMA, Single Strategy, Self-Directed), which can be selected and customized at will. You can include or exclude proposal components, such as a summary of the risk assessment, as well as re-order the order components are delivered—to best suit your story.

Additionally, the proposal output has been re-designed for a better overall investor experience. While the core investment stories remain the same, the content layout, system-generated fact sheets, and the supporting charts and graphs have been enhanced for greater clarity and aesthetic appeal.

Want a tour of the new proposal system? Join us on July 27th at 4:00 PM EST for a live demo. Click here to register now.

What will happen to our legacy proposal system?

The legacy proposal system will be phased out with the build. A data migration project will be completed to source all in-process proposals into the new proposal system. On July 27th, you’ll be able to pick up an in-process proposal seamlessly, with no disruption to service.

The new proposal system will be made available in the legacy advisor portal. Simply navigate to the proposal system, as you do today, then you’ll be directed to the new and improved experience. A training video will be accessible from within the proposal system, which will provide a brief walk through of the new functionality.

For additional information, please refer to our proposal system transition FAQ, here.

-

Enhanced Risk Scoring Methodology and Assessment:

In addition to an improved proposal system, we’re excited to announce a complete revamp of our investment and client risk scoring process.

Client Risk Scoring – Our client risk tolerance assessment is being simplified, with the goal of providing a more straightforward and transparent investment process. The risk assessment evaluates client risk attitudes, time horizon, and investment goals through seven simple, yet critical investment questions. Click here to review the new assessment.

Investment Risk Scoring – The methodology used to evaluate and score investment risk is also being enhanced, through collaboration between Orion’s Investment Committee and Investment Strategy Research Group. The new risk methodology, which is now aligned and consistent across all Orion brands, is designed to help advisors manage investment portfolios in line with client expectations, through a risk score that is more nimble—or responsive to the changing market landscape. Click here to learn more about the new risk methodology.

How can you evaluate the effect these changes will have on your portfolios?

To review the risk changes ahead of time, and impacts on each registration, we have made available a new report— Registration Risk Score Changes Legacy vs New. The report can be accessed through the new advisor portal experience:

- Navigate to the new portal experience (through the banner at the top of your advisor portal)

- Open the integrations menu, expandable with the window icon in the top right hand corner of your navigation toolbar

- Select the “Data Queries” application

- Search “Registration Risk Score Changes Legacy vs New”

- Run and download the report

The report will provide a comprehensive overview of each registration that uses third-party strategist models. Please note that self-directed sleeves will not be represented.

For portfolios that require adjustment, we are enhancing our legacy portal technology to help guide your allocation changes. You can now review and adjust risk with the following steps:

- Navigate to the Household Overview dashboard to review registration risk (aggregate and by model)

- Select the newly available “Sleeve Maintenance” button

- Adjust underlying allocation percentages, which will show risk changes in real time, before the changes are solidified.

- Select “Process” to execute desired trades

Click here for a quick video tutorial of the new Household Overview/Sleeve Maintenance integration.

Additional details about the risk scoring changes can be found in our comprehensive enhancements resource center. Click here to see a complete overview.

-

Rebranded UMA Diversification Process:

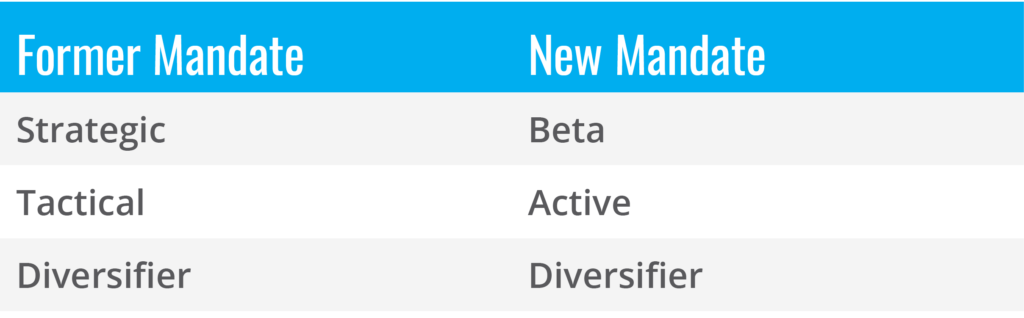

Sound investment strategy is key to long-term financial success. That’s obvious. But what’s also clear is a solid investment process is only useful if clients can understand it, and ultimately, adhere to it. That’s why we are rebranding our three-mandate UMA diversification process to Market Cycle Mandates—to help clients more readily understand the importance each mandate plays in their portfolio.

In addition to a new name, which is more aligned to the core driver of our investment process, the mandates are being renamed to better represent the associated investment strategies within each category.

These changes will be reflected in our UMA proposal output, and updated advisor marketing material will be made available at launch.

We hope you share in our excitement for the upcoming technology release, with enhancements scheduled to roll out on July 27th. If you have any questions, please don’t hesitate to reach out to your Orion Portfolio Solutions Regional Sales Team at 800.379.2313, option 1 or empower@orion.com.

1866-OPS-7/22/2020